1. Introduction

The bull market in bonds that started almost 40 years ago in 1982 has come to an end in 2022. LQD, the largest investment grade corporate bond ETF, is down 16% since the beginning of the year. The 10-year US treasury bond, considered by many asset managers as the risk-free benchmark, has seen its yield jump from 1.5% to 3.17% in the last 6 months. The current market turmoil can be seen in two ways. Bonds may play a more significant role in retirement planning going forward as this could be a great opportunity for retirees and savers to earn attractive returns without much risk. On the other hand, this could be just the start of a large downturn in the bond market as inflation spirals out of control and rates continue rising for the foreseeable future. By revisiting some of the basics about bonds, the different types of risks associated with them, and some historical examples of bond market turmoil, we hope to provide some clarity as to whether this drawdown is an opportunity, or an indicator that the credit market isn’t as healthy as we thought.

2. Bonds: What They Are and How They Work

A bond simply represents a loan made by an investor to a borrower. Bonds are used by companies, governments, and municipalities to finance projects and operations. Large organizations typically need much more money than banks can provide. Bonds solve this by allowing many individual investors to assume the role of the lender and each lend a portion of the capital needed. Each bond issued by a borrower will include various terms of the loan, such as the end date when the principal of the loan is to be paid back (known as the maturity date), the interest payment dates, and the interest payment itself (known as the coupon). The annual interest rate that bondholders earn for lending their funds to the borrower is known as the coupon rate.

Certain fixed income instruments, such as Guaranteed Income Certificates (GIC’s) can’t be traded once they are purchased and must be held until maturity. However, most bonds don’t have to be held by lenders until the maturity of the loan. They can be sold to other investors in the secondary market, where prices fluctuate based on interest rates. Bond prices rise when interest rates decrease, and prices decrease when rates increase. This inverse relationship can best be explained through an example.

Let’s assume a corporate bond has a face value ($ value returned to bondholder at maturity date) of $1000 and an interest rate of 5%, meaning the issuer pays the bondholder $50 each year in interest. Also, assume that the overnight rate set by the Bank of Canada is also 5%. An investor would be indifferent to investing in government bonds or the corporate bond as each would pay $50 a year assuming both bonds had identical risk profiles. However, the economy slows down and the Bank of Canada decides to lower the overnight rate to 2.5%. The corporate bond is now much more attractive as the government bonds pay half as much annually in interest, which motivates investors to buy the corporate bond up until the face value reaches $2000, at which point the $50 interest payment represents a 2.5% yield, just like the government bond. Similarly, if the Bank of Canada were to raise interest rates to 7.5%, this would make the corporate bond much less attractive, meaning investors would likely only buy the bond at $667 as this price would mean the $50 interest payment represents a 7.5% yield.

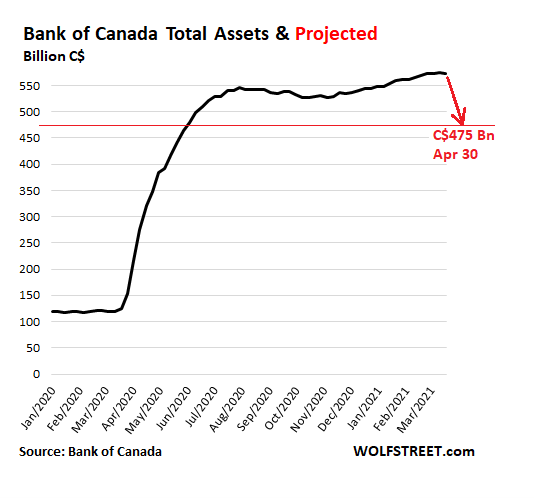

This example demonstrates the inverse relationship between interest rates and bond prices, which brings some clarity to the correction we are currently seeing in the bond market. The Bank of Canada has responded to record levels of inflation by raising interest rates much quicker than was expected just a year ago. As the overnight rate has risen, this has made other bond yields less attractive on a risk adjusted basis, leading to the correction we are seeing right now in the markets. Additionally, the Bank of Canada purchased lots of bonds after the pandemic due to concerns that the poor credit market conditions would lead to further economic collapse. These purchases are gradually slowing down as of late, meaning there is much less buying pressure for bonds as of late. Here’s a chart that shows the BOC’s total assets, which demonstrates the rapid increase in purchases in 2020 and stagnation recently. This trend is expected to continue going forward and the bank may even consider selling some of the assets it has accumulated in the past 2 years, putting even more downward pressure on bond prices.

Figure 1. Bank of Canada Total Assets

At this point, it’s important to mention that an investor who holds their bond until maturity will not experience any losses despite the price volatility. Bond prices fluctuate in the secondary market where investors can trade bonds between themselves, however for investors who simply hold the bond until the maturity, their return is essentially locked in the moment they purchase the bond. For example, let’s assume you purchase a 10-year government bond with a face value of $1000 for $1100 and an interest rate of 2%. Then interest rates rise, making the bond less attractive and the price falls $900. The investor who purchased the bond for $1100 will still receive a 2% interest payment annually and $1000 dollars at the maturity of the bond. She could have purchased it later and received a better rate of return, but the downturn in the market hasn’t affected the return she expected when she made the trade.

3. Risks Associated with Bonds

So does this mean bonds are risk free? Not necessarily, as bondholders face several risks that could prevent the expected return from actually coming to fruition. The 6 major risks are listed and described in detail below.

- Interest Rate Risk

As discussed previously, if prevailing interest rates rise, bond prices will go down. If an investor needs to sell their bond before maturity due to liquidity constraints, this may lead to a loss or reduced return on investment.

- Credit Risk

Bondholders need to consider the possibility that the counterparty they have lent funds to isn’t able to meet their debt obligations in the future. With government bonds, this risk is quite low (but not impossible as we will see a bit later). On the other hand, with corporate bonds it is much more common that companies over leverage and then don’t have the resources to repay the debt. To mitigate this risk for investors, credit rating agencies such as Moody’s will assign ratings to debt offerings which indicate how likely it is for companies to default on their loans. Despite this, a good rating does not guarantee a company won’t default, as unexpected circumstances can arise that impact a company’s operations. For example, in 2008 Lehman brothers was still considered investment grade (the highest rating possible) by Standard and Poor’s just 6 days before the company would collapse.

- Inflation Risk

This refers to the risk that inflation is higher than the rate of return of the bond, implying a loss of purchasing power over time. For example, the most recent inflation estimate by the government of Canada was 7.7%, however, 30-year Canadian treasury bonds only yield 3.3%. Therefore, the real interest rate is 3.3% – 7.7%, or -4.4%, which implies a loss of purchasing power over time. Overall, bonds may be better to hold onto than cash if you don’t need liquidity, but in inflationary periods they may not provide a real return when it comes to purchasing power.

- Liquidity Risk

This risk refers to the investors ability to sell their bond quickly. Government bonds will typically have an active market to buy or sell into, but corporate bonds can be very illiquid at times due to few buyers and sellers. In an illiquid bond market, the spread between bids and asks will be wider, and investors will see substantial volatility which can affect the total return if the bond is sold.

- Call Risk

The last risk worth mentioning relates to bonds with a call provision. Companies may issue bonds with a provision that they can repay the loan at any point before the maturity of the loan. Bonds are called when interest rates decrease from the initial issuance, as companies can reissue the debt at a lower interest rate and decrease their cost of borrowing. This wouldn’t lead to a loss for the investor; however, their expected return won’t be as high compared to holding the bond to maturity.

4. Stocks vs Bonds

Now that we understand the risks associated with bonds, it’s important to understand how the bond market compares to the stock market. First of all, a bondholder is a creditor, which has priority over stockholders in the case of liquidation. This simply means that if a company decides to liquidate its assets, it must pay back all bondholders before returning capital to shareholders. Creditors aren’t guaranteed to get their money back in the case of a liquidation, but the higher priority does reduce the risk associated with bonds relative to stocks. However, with higher risk comes a higher reward, and stocks have historically outperformed when it comes to total returns.

Another difference is that bonds pay out interest payments whereas some stocks pay dividends. While bondholders receive interest payments on a regular basis, stockholders may receive a dividend, but these payments can decrease or stop being paid at the company’s discretion, whereas failure to meet interest payments to bondholders is only acceptable in the case of a default or if an agreement is arranged with relevant parties. Today, fewer companies are paying dividends to shareholders and are instead reinvesting retained earnings into growing the company, meaning investors seeking consistent cash flow will find more options in the bond market.

Finally, the total size of each market is a key difference between stocks and bonds. Despite the fact that stocks get most of the media attention, the bond market is actually surprisingly bigger. The market capitalization of the worldwide bond market is $119 trillion, whereas the worldwide stock market is sitting at just over $70 trillion. This in tandem with the increased liquidation priority makes the bond market much more influential than the stock market in terms of overall economic growth. If the stock market isn’t performing great, this doesn’t necessarily mean the bond market is in bad shape as well, but if the bond market isn’t in the best condition, it is very likely this will spread to stocks and cause widespread damage. Greg Foss, a Canadian bond trader with over 30 years of experience has a metaphor that exemplifies this relationship “if credit is like the dog, equity is the tail”.

5. Bond Market Turmoil: Historical Examples

Now that we have a high-level understanding of how the bond market works and its relationship to stocks, let’s take a look at some historical examples of bond market collapses to see if there are any similarities with the current situation we are facing. It’s important to differentiate between sovereign debt and corporate bond defaults here. A sovereign debt default refers to a nation state that fails to meet its debt obligations. Governments are hesitant to default on their debt as this typically prevents access to the lending markets for a period of time. Even after this period the cost of borrowing is very high. One of the common strategies for avoiding this event is simply printing more of the domestic currency. However, this can devalue the currency significantly, which can cause significant economic damage. In 2020, Lebanon defaulted on its euro denominated debt, which has accelerated the economic damage of Covid. When a country has debt that isn’t denominated in its own currency, it can be very difficult to raise enough funds to repay the obligations during a downturn in the economy. Since printing the currency isn’t an option, and increasing tax rates would further hurt the economy, governments aren’t left with many alternatives outside of a default.

Even with record debt levels in the US and in Canada, it’s unlikely that either country defaults on its debt despite the increase in interest rates. Both countries hold a lower percentage of their debt in foreign denominated currencies. Additionally, they just printed record levels of money to support the economy during the pandemic, and while this has contributed to the inflationary environment we are seeing today, it has not significantly devalued the currency to the point where a default would be considered a possibility. While we haven’t seen a significant negative impact from the increased levels of debt ever since 2020, money cannot be endlessly printed as was seen in Venezuela recently. Of course, a much higher percentage of Venezuela’s debt was in foreign currency, which made it much more vulnerable to a sovereign default, but this situation does demonstrate the limits to printing money as hyperinflation may ensue.

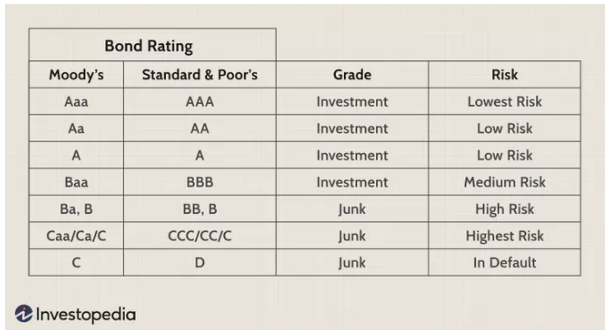

Sovereign defaults are much less common than corporate bond defaults. Corporate bonds range in quality from investment grade to junk bonds. As discussed earlier, credit ratings assigned by rating agencies determine the quality of debt. Lower quality debt that has a high chance of default would be considered junk bonds, whereas companies with consistent cash flows and low interest coverage ratios will be considered investment grade. The table below shows the distribution of ratings in more detail.

Figure 2. Bond Ratings

Corporate bonds do offer higher interest rates to compensate for the increased risk of default. In 2020, the pandemic led to panic selling of pretty much everything. Corporate bonds were sold as everyone rushed to cash, but as we mentioned earlier, there isn’t much liquidity for corporate bonds, and this led to a feedback loop where bond prices fell rapidly. AT&T, the telecommunications giant, was the most indebted company in the world at the time, with over $147 billion in long term debt. As investors sold bonds across the risk spectrum, AT&T bonds fell in price. This led to higher interest rates and concerns that AT&T would be unable to pay back its debt as it would be unable to roll over its existing bonds at reasonable interest rates. This led to further capitulation, to the point where AT&T was close to becoming downgraded to less than an investment grade bond.

Typically, pension funds and institutional investors have mandates that require them to only hold investment grade bonds or retain a certain percentage of the fixed income portfolio in investment grade instruments. If AT&T were to be downgraded, all these funds would be mandated to rebalance their portfolio. This would imply selling the AT&T bonds, increasing the risk of default and pushing interest rates even higher. Then, to preserve capital after taking a loss on the AT&T position, institutional investors would likely sell other bonds, leading to further drawdowns across the entire market. Credit contagion is the expression commonly used to describe this phenomenon, where one default or downgrade can be the first domino in a much deeper correction across the credit market. The US government saw this coming, and for the first time in its history, decided it was necessary to buy corporate bonds and provide support to the corporate credit market. Of course, this doesn’t mean the debt disappeared, it was simply transferred to the government, whose central bank can print unlimited funds to finance government bond issuances.

This situation provides some clarity as to what we can expect if credit markets were to continue dropping. It’s likely that the government would have to step in at some point to provide liquidity. However, one significant difference is the high inflation we are currently experiencing. This makes it much more expensive for the government to borrow to supply liquidity, which technically increases the risk of sovereign default. While it’s unlikely we see a credit market correction of equal size to the one in 2020 without a serious recession, investors should be cognizant of the possibility for one default to spread and cause many defaults. With this in mind, due to the inflationary environment, governments would likely be more hesitant to support the credit market, which may prevent them from intervening before it’s too late.

6. Conclusion

Bonds are debt instruments used by governments and businesses to raise funds in excess of what banks can provide. Increased interest rates have put pressure on bond prices in recent times, and the inflationary environment has led real interest rates to trend negative for the past year and a half. Overall, while there are some differences from past bond market corrections, the governments of first world countries historically do have the resources to prevent a prolonged crisis, meaning the credit market drawdown is likely just a temporary response to higher-than-expected interest rates, and not the start of a deep downturn. Regardless, bondholders who plan on holding their investments until maturity only need to worry about the risk of default, which remains very low for government and investment grade bonds at this moment.

Author: Rodrigo Anzola

Sources

- “iShares iBoxx $ Invesment Grade Corporate Bond ETF”, 2022.

- Charles Schwab. “2022 Mid-Year Outlook: Fixed Income”, 2022.

- “6 Biggest Bond Risks”, 2022.

- The Guardian “Lehman Brother Collapse, was capitalism to blame?”, 2013.

- Wolf Street. “Bank of Canada Announces Balance Sheet Reduction, Suddenly Worried About Moral Hazard”, 2021.

- “Sovereign Default”, 2022.

- “How are Bonds Rated”, 2022

- Greg Foss. “Why Every Fixed Income Investor Needs to Consider Bitcoin as Portfolio Insurance”, 2021