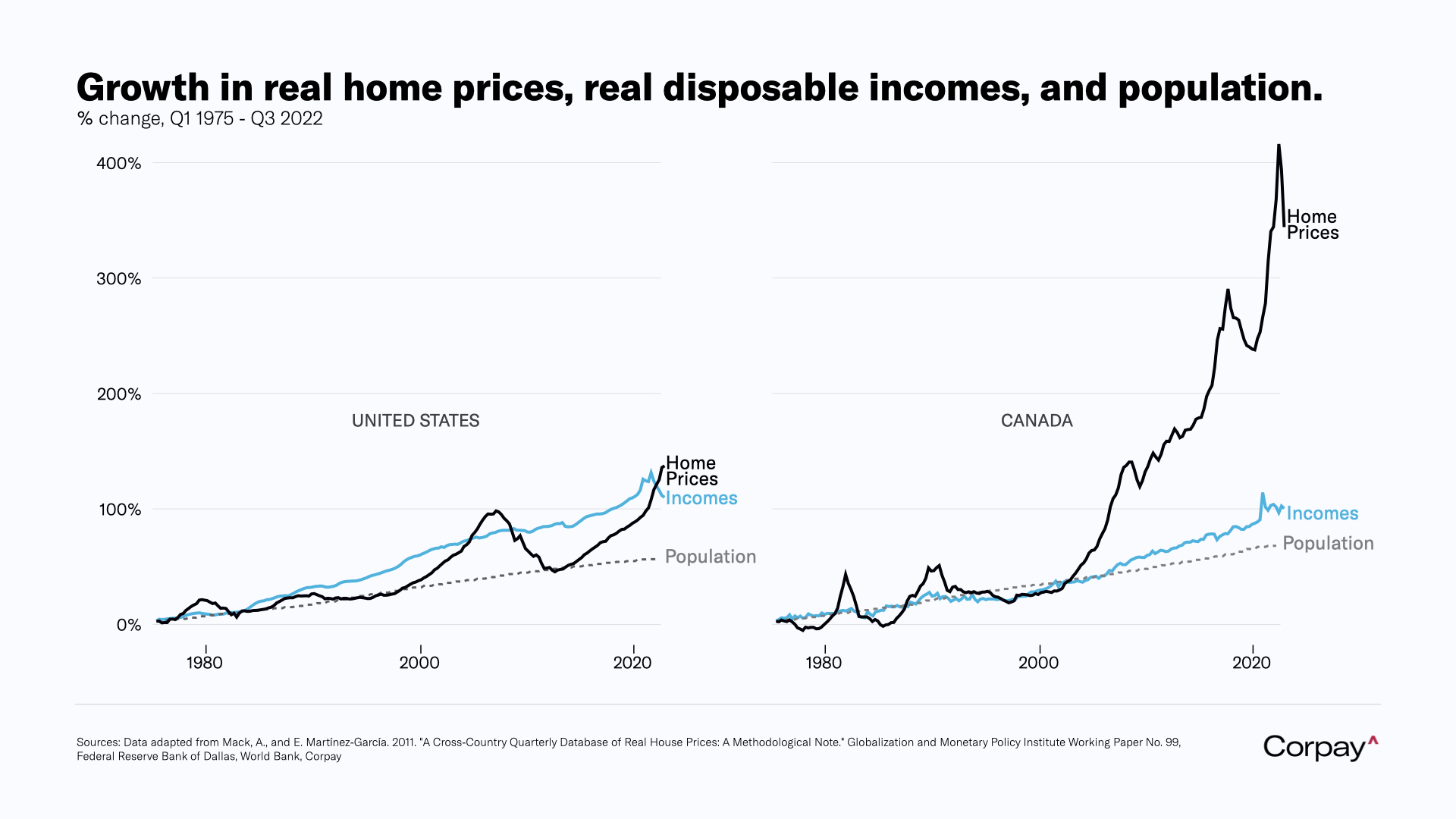

The rise in housing prices and deteriorating affordability conditions in the last decade have greatly impeded millennials’ climb up the housing ladder. In a viral Twitter post Karl Schamotta, chief market strategist at Corpay, shared the below chart showing how drastically home prices have outpaced increases in disposable household income, which has led many people to stay in the rental pool and delay homeownership much longer than they would like. Pressured to address the issue, the federal government introduced a new registered plan that will give first-time home buyers the ability to save up to $40,000 on a tax-free basis to purchase a qualifying home. We take a look at the First Home Savings Account (FHSA), how it works, and how it fits into the bigger picture of financial planning.

Plan Design and Eligibility

The FHSA could be viewed as a hybrid between an RRSP and an TFSA. The plan allows account holders to contribute on a pretax basis like an RRSP, so any contribution would lower taxable income for year when it is claimed. Like the TFSA, any contributions and investment income can be withdrawn tax-free. Anyone who is a resident of Canada, above the age of 18, and not turning 72 or older in the year can open and fund an FHSA. You must be a first-time home buyer, and neither you nor your spouse or common-law partner should have owned a qualifying home that you lived in during the year the account was opened or during the four preceding calendar years.

Contributions and Deductions

There is an $8,000 annual contribution limit and a $40,000 lifetime contribution limit. If you contribute less than $8000 in any given year, you can carry forward the unused portion of the annual contribution room in subsequent years. Contribution room carries forward, but catch-up contributions are capped to a limit of $8,000. This means that the maximum contribution one can make in a single year is $16,000, equal to the maximum catch-up amount plus the annual contribution limit. Contribution limits apply to contributions made during the calendar year, similar to a TFSA. Unlike an RRSP, contributions made in the first 60 days of the calendar year cannot be attributed to the previous year.

FHSA contributions can be applied as a deduction against all sources of taxable income. The exact amount of tax savings will depend on your marginal tax rate. If you contribute to your FHSA, you do not have to claim a deduction for that year. Like RRSP deductions, you will be able to carry contributions forward indefinitely and deduct them in a later year when your income might be higher and the deduction could lead to a larger reduction in tax payable.

Like with other registered accounts, overcontributions are taxed for each month or part-month the account exceeds the limit. A 1% penalty tax applies to the highest amount of the excess that existed in that month.

Qualifying Investments, Income and Gains

The list of qualified investments for the FHSA is the same as it is for TFSAs. After you contribute to the account, you can choose to invest in mutual funds, exchange-traded funds (ETFs), publicly traded securities, government and corporate bonds and guaranteed investment certificates (GICs). The prohibited investment and non-qualifying investment rules applicable to other registered plans will remain the same for FHSAs. Some examples are non-arm’s length investments, land, private company shares and general partnership units.

Most importantly, income and capital gains produced in an FHSA will not be included in your annual income for tax purposes. This means that investments will compound on a tax-free basis inside the account just like they do in a TFSA.

Withdrawals

It’s important to mention that in order to make tax-free withdrawals, the account holder must be a first-time homebuyer. For the purposes of this account, this means that the individual has not owned a home during that calendar year and in the preceding 4 years. If the account holder decides that they are no longer purchasing a home or they have some left over funds in the account after making a down payment, funds can be transferred to an RRSP or withdrawn on a taxable basis. Transfers to the RRSP are penalty free, and this doesn’t impact the taxpayer’s contribution room. There is also an option to transfer funds in an RRSP directly to an FHSA, however in this case a transfer would not reinstate the RRSP contribution room lost. It is also important to note that the FHSA will be closed 15 years after opening the account or when the account holder turns 71.

Comparison with the Home Buyers’ Plan (HBP)

Unlike the RRSP, you wouldn’t be able to contribute to your spouse or common law partner’s FHSA and claim the deduction under your name. Additionally, the Home Buyers’ Plan (HBP), which allows RRSP holders to withdraw $35,000 from their RRSP without a withholding tax to purchase their first home, cannot be used in tandem with the FHSA. The key difference to mention between the two plans is that the $35,000 withdrawn from the RRSP must be paid back within 15 years, starting the second year after you withdraw the funds. Any missed payments will result in a loss of RRSP contribution room permanently. These payments would still eventually be subject to tax, therefore the FHSA also provides more of a tax advantage since contributions are deductible and withdrawals are not taxed if the aforementioned conditions are met. Despite the drawbacks of the HBP, there are certain instances where it may be preferred. For example, if you were planning on buying a home in the next couple of years, the FHSA would only allow you to save $16,000 based on annual contribution limits, while up to $35,000 could be withdrawn from the RRSP.

Open an FHSA immediately

As discussed above, you will receive $8,000 worth of contribution room every year, up to a lifetime maximum of $40,000. This contribution room can be carried forward. However, the FHSA has an interesting quirk. Contribution room only starts accumulating after the account is open. For example, if you wait a year after the account is introduced, and you open an FHSA in 2024, you will only be able to contribute $8,000. If you, however, open the account in 2023, you would be able to contribute $16,000 in 2024.

Always choose FHSA over HBP

If you have maximized the FHSA by the time you plan to purchase a home, it is the better account to use for a down payment. You will accumulate more money in it, and you won’t have to make a repayment. The FHSA also provides a tax deduction and the ability to contribute above and beyond the RRSP limit, whereas the HBP simply allows you to unlock a portion of a pre-existing RRSP.

FHSA Contributions should take precedence over RRSP contributions

It makes sense to contribute to an FHSA before you contribute to an RRSP in case you don’t have the funds to maximize both. This applies even if you have no intention of buying a house. The reason for this is that if you contribute $40,000 to an RRSP and decide you want to buy a real estate property, you can only transfer these funds to the FHSA. Any growth generated by the initial investment will have to stay in the RRSP. On the other hand, if you contribute $40,000 to your FHSA instead, the original amount plus the appreciation can all be withdrawn tax-free to buy a home. In addition, if you contribute to your RRSP first and then transfer funds to your FHSA, you won’t get your RRSP contribution room back, whereas contributing to an FHSA can be done over and above your RRSP deduction limit. Most importantly, you can contribute to an FHSA and then transfer those funds to an RRSP. This transfer won’t use up any of your RRSP contribution room, so these funds become de facto RRSP savings over time.