1. Introduction

The registered disability savings plan (RDSP) is one of the most lucrative yet underutilized registered investment accounts available to Canadians. RDSPs can help people with disabilities improve their financial security, but its terms can be confusing, which can make it hard to take full advantage of all the benefits the account has to offer. Today, we’ll review what the RDSP is, how it works, and how it can be leveraged to enhance financial stability for people with disabilities and those that support them.

2. What is an RDSP?

People eligible for the disability tax credit (DTC) qualify as beneficiaries for the RDSP. They must have a valid social insurance number, be a resident of Canada, and be under the age of 60 to qualify. Additionally, a medical practitioner must certify that the individual has a prolonged impairment in physical or mental functions. The account is intended to help parents and loved ones save for the long-term financial security of someone with a disability. Through the plan, a beneficiary will receive grants and bonds from the Canadian government, plus all contributions get to grow on a tax deferred basis similar to an RRSP. However, unlike the RRSP, contributions made to the RDSP are not tax deductible. Overall, the main advantage provided by the RDSP is that contributions grow on a tax deferred basis where income generated is only taxed upon withdrawal from the RDSP. Additionally, all gains are under the name of the beneficiary, who typically will have lower income than the contributor and thus a lower marginal tax rate.

Account holders represent the person or people who open the RDSP. Despite the fact that each beneficiary can only have one RDSP, there can be more than one plan holder at any given time. Sometimes the beneficiary himself can act as the account holder of an RDSP. This depends on two factors – whether the beneficiary is over the age of 18, and whether he or she is determined to be contractually competent. For a beneficiary under the age of 18, a parent, legal guardian, or public institution has to open the account and act as the account holder. For those over 18, anyone deemed to be a qualifying family member (QFM) or the beneficiary can be the account holder. If the beneficiary is no longer eligible for the DTC, then no additional contributions can be made to the plan. However, the plan does still remain open unless it is canceled by the account holder or beneficiary, which would result in all the funds going to the beneficiary.

3. Contribution Limits and Withdrawal Guidelines

There is no annual limit for RDSP contributions but the overall lifetime limit is $200,000. Once a beneficiary turns 59, funds can no longer be contributed to the RDSP, regardless if there was still less than $200,000 in contributions made. Once the beneficiary wants to withdraw funds, he or she can request a disability assistance payment (DAP). A DAP can be requested at any time and can consist of contributions, investment income, and grants or bonds issued by the government. The portion of the withdrawal that is a contribution is not taxable, however all the other income is taxable upon withdrawal.

The only limit to withdrawals is that the market value of the RDSP cannot be less than the assistance holdback amount (AMA). The assistance holdback amount is the total amount of grants and bonds paid into the account by the government in the last 10 years, less any grants or bonds that were repaid in that same time period. Withdrawing before the age of 60 may require that the beneficiary pay back some of the grants and bonds. For every $1 withdrawn from the RDSP, $3 of grants and bonds paid into the plan in the 10 years preceding the withdrawal are to be repaid, however this amount cannot exceed the assistance holdback amount. Therefore, unless liquidity is urgently needed, or the beneficiary’s health is in question, (discussed further below) it is recommended that withdrawals are not made until the beneficiary is 60 years old so that the account’s value is maximized.

Once a beneficiary does turn 60 years old, the beneficiary must take out a certain portion of the RDSP. For example, if a beneficiary withdraws $1000 from their account, they must continue withdrawing at least $1000 a year going forward. These are known as LDAPs and are also subject to an annual withdrawal limit determined by the formula below.

A / (B + 3 – C) + D

where:

A = the market value of the RDSP at the beginning of the year, less the value of locked-in annuity contracts.

B = the greater of 80 and the age of the beneficiary at the beginning of the calendar year

C = the actual age of the beneficiary at the beginning of the calendar year

D = the total of all periodic payments paid to locked-in annuity contracts,

For example, let’s assume Richard is a 65-year-old beneficiary of an RDSP that is worth $150,000 and he has paid $15,000 to locked in annuity contracts this year. In this case Richard can only withdraw $23,333 dollars from the RDSP. There is one exception to this rule that is worth mentioning. If a licensed doctor or nurse practitioner determines that the beneficiary will not live longer than 5 years, these years are considered “specified years” and the withdrawal limits no longer apply. The only limitation on withdrawals during these years is that the market value of the RDSP must be greater than the assistance holdback amount after any withdrawals. Therefore, if Richard is determined to be in a specified year, and his assistance holdback amount is $35,000, he would only be able to withdraw $100,000 in that year, assuming $15,000 is locked in annuity contracts.

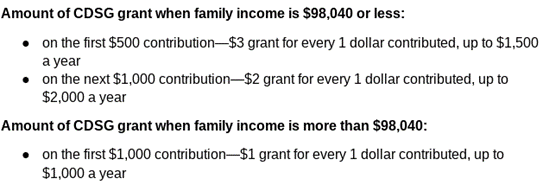

We have been mentioning government grants and bonds throughout this article, so let’s get into how these bonds and grants work. The Canada Disability Savings Bond (CDSB) and the Canada Disability Savings Grant (CDSG) are paid into the RDSP by the federal government. Matching grants of 300% to 100% are made depending on net income and the amount contributed to the RDSP. If the beneficiary is under the age of 18, the family’s net income will be used to determine the benefit, but after the age of 18, net income is calculated as their personal income plus their spouses or common law partner’s income. An RDSP can get up to $3500 in grants annually, and up to $70,000 over the beneficiary’s lifetime, but grants are only received on contributions prior to the beneficiary turning 49. Grants are calculated using the quotas shown below.

Let’s assume Ben, a 29-year-old beneficiary of an RDSP, has a combined net income with his spouse of $70,000, and decides to contribute $1500 to the RDSP. He would receive a grant of $3500, meaning that the total contribution including grants is actually $5000 instead of $1500. This example demonstrates just how significant the RDSP can be in improving the financial situation of people with disabilities; a small contribution of $1500 actually resulted in an increase in the account value by $5000, and any growth is tax deferred until it is withdrawn.

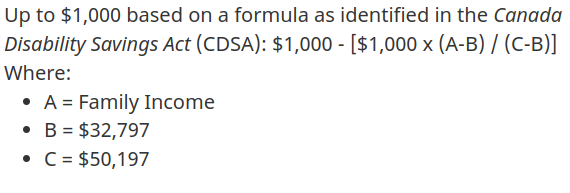

Moving on to the CDSB, the government does pay a bond of up to $1000 a year to low-income Canadians with a disability. No contributions have to be made to qualify for the bond, but there is a lifetime limit of $20,000 and bonds will only be paid into the RDSP until the beneficiary turns 49. A beneficiary with less than $32,028 in family net income will receive the full amount of $1000. For those with income between $32,028 and 49,020, the formula below is used to calculate the total amount.

For example, if a beneficiary’s family net income is $40,000, then the total amount of the bond would be $706 for that year. Then for anyone earning more than $49,020, there is no bond contributed by the government. There is carry forward for unused grants and bonds in past years. As long as you are eligible in the years that you are carrying forward, up to 10 years of grants and bonds can be carried forward. However, there is an annual maximum of $10,500 for grants and $11,000 for bonds that can be carried forward.

4. What Happens if the Beneficiary Passes

In situations where the beneficiary of an RDSP passes away, the account must be closed and the amount remaining in the account is paid out to the estate of the beneficiary. Plan holders who made contributions do not receive their funds back. Additionally, some of the grants and bonds paid into the plan by the government must be paid back. All grants and bonds during the 10 years prior to the death of the beneficiary must be repaid and cannot be paid out to the estate.

5. Conclusion

The RDSP can be an incredible tool for people with disabilities or those with loved ones who have disabilities to improve their financial position through tax sheltered growth, grants and bonds paid by the government, and a lower tax rate on capital gains. Despite its advantages, the RDSP is underutilized due to the wide variety of confusing terms, limits, and conditions that make it difficult to understand how to take full advantage of the account. Canadians should have a high-level understanding of how the account works, as there are limits to withdrawals that can significantly limit the total grants available. It can be beneficial to bring on professional help in the form of a financial advisor to help maximize the benefits of this account while ensuring there is still sufficient liquidity to support everyday life.

Author: Rodrigo Anzola

Sources:

- Government of Canada. “Registered Disability Savings Plan”, 2022.

- Government of Canada. “Assistance Holdback Amount”, 2019.

- Canada Disability Savings Bond. “Canada Disability Savings Bond”, 2022.

- RDSP Plan Institute. “Frequently Asked Questions”, 2022.