1. Introduction

Exchange Traded Funds (ETFs) have become extremely popular in recent years. Global inflows for 2021 exceeded $1 Trillion for the first time ever, a 36% increase from the previous year. Total assets invested in ETFs have doubled since 2018 to reach $9.5 trillion as of the end of 2021. It’s clear that global investors find ETFs appealing. In this article we will take a look at how ETFs are different from mutual funds, the 2 biggest issuers of ETFs, how ETFs are created and how they maintain appropriate pricing.

2. The Transition from Mutual Funds to ETFs

ETFs are pooled investment vehicles meant to track a certain index or sector of the market. They operate very similarly to mutual funds, except that they can be traded on the market just like a stock would. There is a wide range of ETFs that track pretty much anything imaginable. There is an ETF for momentum trading strategies (MTUM), one for risk parity meant to reduce volatility (RPAR, SPLV), and leveraged ETFs that allow for increased exposure to different asset classes or indicators (SARK.AS, UVIX). Ever since the inception of the first ETF here in Canada in 1990, there has been continual innovation in the space which has made it easy to find an ETF for just about anything.

The interesting thing is that pooled investments are nothing new. Mutual funds were created back in 1924, therefore the real question is, what do ETFs actually bring to the table that mutual funds don’t? First of all, ETFs trade on the public market, which makes them highly liquid compared to mutual funds. If you wanted to sell your position in a mutual fund, the only way to do so is to contact the mutual fund manager and ask for a shareholder redemption, which would involve the sale of assets to fund your redemption. Selling these investments will typically lead to capital gains taxes, which will take away from your total return. Alternatively, for assets held through ETFs, these positions can be sold directly on the public market at any time.

Moreover, a key drawback of mutual funds is the tax implications due to the active trading of securities inside of the funds. Mutual fund managers typically charge a fee in exchange for their investment management expertise. This means they are buying and selling positions regularly, triggering capital gains on a regular basis. On the other hand, most ETFs employ passive management strategies that don’t involve frequent trading. By trading less, these funds make lower capital gains distributions leading to better tax efficiency. Finally, mutual funds have historically charged higher management fees because they are actively traded, whereas ETFs have extremely low management fees as most of them simply track an index or sector and don’t require active management.

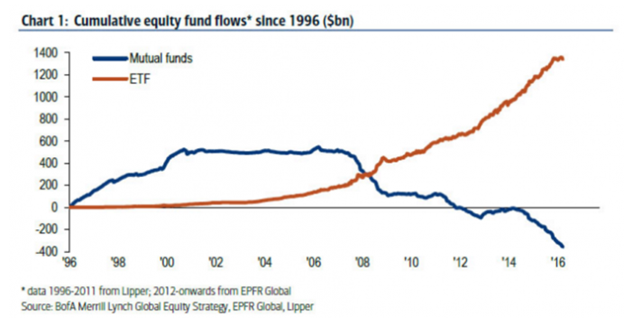

Overall, the increased liquidity, tax efficiency, and lower management fees all contribute to the increasing popularity of ETFs versus traditional mutual funds. Below is a chart that exemplifies this trend.

You can clearly see the rise in ETFs through the red line, but what is more interesting is that the increasing popularity of ETFs has led to significant outflows from mutual funds, indicating that if this trend continues, mutual funds may become obsolete in the future.

3. Vanguard and Blackrock

Now that we understand the benefits of ETFs, let’s look at who is issuing these ETFs. While there are many new entrants in the space, 2 companies stand out as market leaders, Vanguard and Blackrock.

Blackrock is the leading ETF issuer with over $2.1 trillion in ETF assets under management. The investment manager currently offers 161 different ETFs ranging from small cap ETFs to balanced multi asset funds. Fees can range as some ETFs are actively managed, however the average fee charged by Blackrock is only .31%. The most popular ETF Blackrock has issued is IVV, a passively managed ETF that tracks the S&P 500 and has over $278 billion in assets under management.

It’s valid to ask why an ETF needs to be made to track the index when investors can simply go out and buy the index itself. First of all, the S&P 500 index is valued at ~$3800 per share, therefore you can’t get exposure to it for less than $3800. In comparison, the Blackrock ETF only costs $380, therefore smaller investors can get exposure without putting up almost $4000. Another key consideration is the increased liquidity. Index funds trade like mutual funds in that they only trade at the end of each business day. ETFs are highly liquid and can be traded at any time the market is open.

Vanguard is the other major player when it comes to issuing ETFs. With over $1.6 trillion in ETF assets under management, Vanguard has 76 different ETF offerings that include international emerging market ETFs and total market indexed ETFs. They are historically very cheap in terms of fees, with an average management expense of only .09%. The most popular Vanguard ETF is the Vanguard Total Market ETF VTI, which has over $122 billion in assets under management and fees of just .03%. This ETF tracks a range of large to small cap companies globally. The ETF mainly focuses on large to mid-size value stocks, however it does have positions in the growth and small cap area to provide diversification.

4. How ETFs are Created and Maintained

ETFs are developed and maintained through a process known as creation and redemption. A prospective ETF manager (more commonly known as the sponsor) will file an investment plan with its respective securities commission to create an ETF. If this is approved, the sponsor will then proceed to get into an agreement with another authorized participant. This is generally a large financial institution or market maker, but in some cases can be the sponsor as well.

An ETF is simply a basket of securities; the authorized participant is responsible for purchasing the securities that make up the ETF on the open market. They then deliver these shares to the sponsor in exchange for a block of ETF shares known as a creation unit that can be split up and sold in the public market. Each creation unit is typically 50,000 shares in the underlying ETF. The process of exchanging securities for shares is not a taxable event as no money is changing hands, just shares in individual companies to shares of the ETF. When the ETFs shares are bought and sold on the market, the basket of securities that formed these shares remain in the account set up by the sponsor, therefore there is no impact of these transactions on the underlying securities.

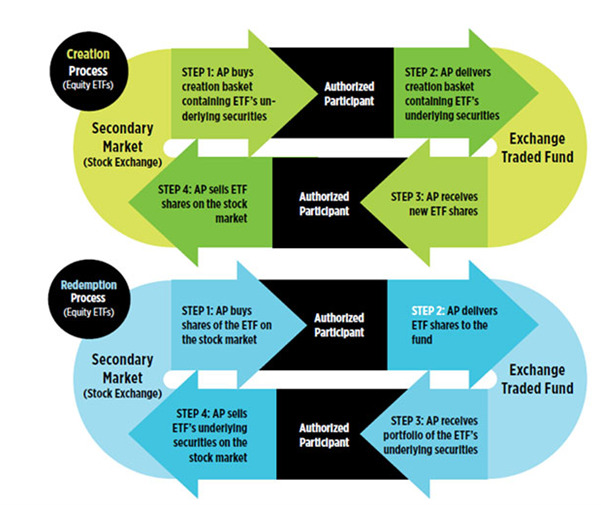

Alternatively, investors can sell their ETF shares directly to the sponsor by exchanging a creation unit of the ETF for the underlying securities in the sponsor’s account. This is typically reserved for institutional investors as the number of shares needed for a creation unit requires a lot of capital. Here’s a diagram that shows the creation and redemption process from a high level.

Figure 2. The Creation and Redemption Processes

Now that we have a high-level understanding of ETF creation and redemption, we can take a look at how ETFs leverage this process to be more tax efficient than mutual funds. As mentioned before, when mutual fund investors redeem shares from a fund, shares of the underlying positions are sold, meaning all shareholders of that fund are affected by the capital gains tax that is incurred on that sale.

When an investor would like to redeem their ETF creation unit, the sponsor will exchange the shares of the underlying securities with the lowest cost basis. This means that the cost basis of the ETFs holdings is now higher, which reduces the capital gains it pays. Additionally, this won’t impact the redeemer, as their tax liability is dependent on the purchase price of the ETF shares, not the funds cost basis. To better understand this, let’s use an example. Let’s assume an investor wanted to redeem shares in SPLV, which is an ETF that tracks the 100 companies in the S&P 500 with the lowest volatility. They would exchange shares of SPLV with the sponsor in exchange for and equal value of shares in the underlying positions, which are individual companies such as Pepsi or Waste Management. When ETF shares are created, the purchase price of these holdings can vary widely based on market conditions at the time. Therefore, the sponsor will have shares in each company at different purchase prices. The shares with the lowest purchase price for each holding will be the ones the sponsor uses for the redemption, therefore the average cost basis for the rest of the position increases.

Circling back to SPLV, the Pepsi shares held by the sponsor of SPLV may have a cost basis that ranges from $50 to $170, with an average cost basis of $110. In the case of a redemption, the sponsor would exchange the Pepsi shares with a purchase price of $50, meaning the average cost basis would increase to more than $110. Now if the ETF sponsor were to sell its position in Pepsi, due to the higher cost basis the capital gains tax is lower than before. Capital gains taxes are calculated on the difference between the purchase price and the price the security was sold at, therefore by reducing this difference, the tax burden for this sale is also reduced. For the redeemer, this won’t impact their tax liability because the capital gains they receive will be on the sale of the ETF shares, not the underlying holdings.

A common concern with ETFs is that the value will deviate from the underlying holdings due to the fact shares are traded on the open market. This is a valid concern, but the opportunity for arbitrage makes this nearly impossible. Let’s go back to SPLV, assume that shares in the ETF are trading at $60 per share. After each business day, the sponsor of the ETF will release an updated value of the underlying holdings, better known as the Net Asset Value (NAV). If the NAV per share is higher than $60, then institutional investors are incentivized to redeem ETF units and sell the underlying holdings on the public market. By increasing the sell pressure of the underlying positions and reducing the supply of ETF shares, the arbitrageurs actions will eventually lead the ETF back to a value that aligns with the NAV of the ETF.

Arbitrage also resolves price discrepancies when the NAV is below the ETFs price on the market. Institutional investors would create ETF shares by buying the underlying holdings and exchanging them for creation units in the ETF, which would then be sold on the public market. By increasing the demand for the underlying holdings and increasing the supply of ETF shares, the arbitrageurs eventually make the ETF return to its NAV.

5. Conclusion

The growth in ETFs indicates that they are here to stay and investors should embrace the advantages they bring to the table. While mutual funds have been the go-to pooled investment for many years, the increased tax efficiency and affordability of ETFs has led to a dramatic increase in inflows for ETFs. Both Blackrock and Vanguard offer an ETF for pretty much anything you could imagine, and the passively managed ETFs they developed have outperformed almost 95% of mutual funds over the past 10 years, indicating that lower costs don’t lead to lower returns. Sponsors are able to provide such cheap offerings through the creation and redemption process for ETFs, which is extremely tax efficient and prevents mispricing due to arbitrageurs.

Overall, ETFs need to be taken seriously by every investor, as they could be one of the best vehicles for generating long term returns that aren’t drastically reduced by unnecessary fees and taxes. While excessive financial innovation may have led to economic collapses in the past as with mortgage-backed securities, it seems clear that this innovation may genuinely help more investors reach their retirement goals much more comfortably.

Author: Rodrigo Anzola

Sources

- “Inside The Growing Popularity of ETFs”, 2021

- “Why Are ETF Fees Lower Than Mutual Fund Fees?”, 2022

- “ETFs post a Record $1 Trillion of Inflows in 2021”, 2021

- com. “Blackrock ETF Channel”, 2022

- com “What Is The Creation/Redemption Mechanism”, 2021

- Morningstar “How is an ETF created?”, 2021