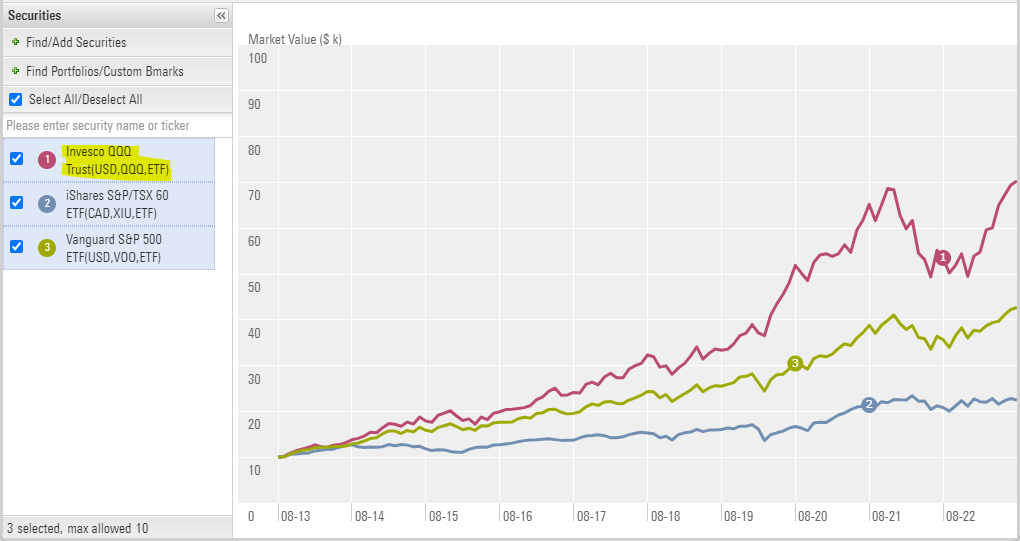

The Invesco QQQ ETF ranks as one of the world’s most popular investment products. Managing over $202 billion in assets, the fund follows the 100 largest non-financial companies on the Nasdaq. As of September 19th, 2023, the ETF has posted a 39.3% increase for the year, outperforming the S&P 500’s 16.5% return by more than double. The S&P 500 tracks the 500 largest companies in the US. Over the last decade, the ETF has delivered an average annualized return of 21.5%, significantly outpacing the S&P 500’s 15.6% and the TSX 60’s 8.4%. The TSX 60 follows the 60 largest companies in Canada. In this article, we will examine the fund’s inception and the history of the Nasdaq exchange to understand why the ETF has so dramatically outperformed North American markets and assess its potential for continued success.

The Nasdaq Exchange

The Nasdaq is an electronic stock exchange where buyers and sellers can trade stocks of many different companies. Household names such as Apple, Microsoft, and Amazon are all examples of the companies that trade on the exchange. The Nasdaq was launched in 1971 and was the first electronic trading system in the world. In the 1970’s, stocks used to be traded over the counter, meaning buyers and sellers would exchange shares directly with each other over the phone or on the trading floor. The Nasdaq exchange was different in the sense that it was a dealer market, where brokers buy and sell stocks through a market maker rather than from each other. Market makers handle inventories of specific stocks and when brokers want to purchase or sell these shares, they do so directly with the market maker. This was revolutionary at the time because brokers could now see the bid and ask prices for any company listed on a single screen. With traditional floor-based markets, investors would simply see the historical prices of trades executed in the past.

Introducing a surprising figure in the Nasdaq’s history, Bernie Madoff was actually a key influencer in its early years, playing a significant role in shaping the modern stock market. To compete with firms on the New York Stock Exchange, Madoff’s firm pioneered the use of innovative computer technology to share its quotes. This technology eventually evolved into what we now know as the National Association of Securities Dealers Automated Quotations Stock Market, or Nasdaq. In 1990, Madoff took on the role of nonexecutive chairman of the Nasdaq. He played a significant role in developing the systems and market structures that transitioned stock trading from the physical trading floor to the realm of electronic trading. Far from his later infamy, Madoff was once a legitimate businessman who made substantial contributions to the financial industry.

Due to its innovative approach to trading, the Nasdaq exchange established itself as the preferred listing venue for the most innovative companies in the US. Intel listed on the Nasdaq in 1971 and was followed by Apple in 1980 and then Microsoft in 1986. In the 1990’s the Nasdaq branded itself as “the stock market for the next 100 years” and continued to draw interest from technology companies looking to raise capital in the public markets. However, this backfired at the turn of the millennium when technology companies were valued extremely generously and eventually saw huge corrections in their stock price. The “dot com bubble” led to an 80% correction in the Nasdaq index, a basket of the 100 largest companies listed on the exchange. Prices didn’t recover until the summer of 2015, nearly 15 years after its peak in the beginning of 2000.

The Invesco QQQ ETF

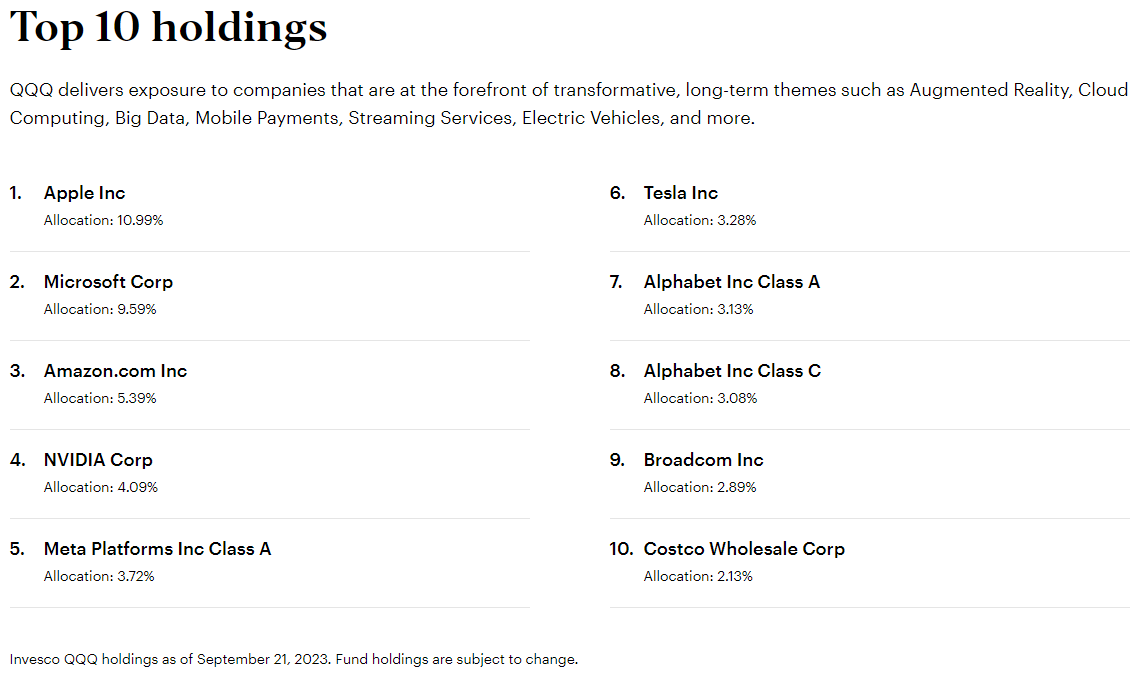

The Invesco QQQ ETF started trading on March 10th, 1999, less than 1 year before the technology bubble burst. While the timing of its inception was not ideal, the fund has performed extremely well over the past decade and has consistently outperformed the general market because of its focus on technology companies. For example, in 2023 seven stocks have driven almost all of the growth in the S&P 500. Growth in Apple, Microsoft, Meta, Nvidia, Amazon, Tesla and Alphabet represent about 90% of the growth in the S&P 500 this year, and they are all top holdings in the QQQ ETF. Because of this increased concentration in technology companies, the ETF has done much better than the general market, which is more broadly diversified in sectors such as financials and energy.

Will the Invesco QQQ ETF Continue Performing?

At this juncture, the key question is whether this trend will persist. One major factor behind the success of technology companies over the past decade has been historically low interest rates, which were kept low in response to the pandemic. Low interest rates disproportionately affect the valuation of tech companies because their valuations rely more on future profits than on current earnings. When interest rates stay low, investors find fewer appealing alternatives in safer products like bonds or money market funds, making them more willing to invest in the future earnings of tech companies. However, rising interest rates offer investors better returns with less risk, making them less inclined to invest in future growth.

In the inflationary environment following the pandemic, central bankers had to raise interest rates faster than ever before, resulting in the highest rates Canada has seen in 22 years. This rapid increase triggered a significant correction in 2022 across all tech sectors, with some speculative companies losing more than 90% of their valuations. Yet, in 2023, large technology companies, often called “big tech,” have performed exceptionally well, surprising many investors. This performance comes despite a robust economy and persistent inflation, which have led central banks to maintain higher rates for an extended period. Advances in AI technology drive this growth, as big tech companies lead in AI development and can easily integrate it into their products. Nonetheless, the current economic conditions pose greater challenges for tech companies compared to the last decade.

Higher interest rates also impact other sectors, but not as much as they do technology companies. For instance, financial sector companies base their valuations more on current earnings and dividends than on future growth. Unlike tech companies, which prefer to reinvest earnings back into the business, other industries often pay out a larger portion of their earnings to shareholders, supporting their valuations during challenging times. For example, the Horizons Equal Weight Banks Index ETF, tracking the big six Canadian banks, currently offers a dividend yield of 5.31%, significantly higher than QQQ’s 0.52% yield.

Conclusion

Technology companies have excelled in recent years, but evolving economic conditions could challenge their ability to maintain a lead over the broader market. The ongoing success of the Invesco QQQ ETF will hinge on technology companies enhancing their efficiency and rolling out more innovative products. If they don’t, this decade could mark a shift back to value-oriented sectors like finance or energy, which may outperform growth-oriented companies after years of lagging behind.