In the complex landscape of financial planning, high-income, mid-career professionals often find themselves at a crossroads, grappling with the question: When can work become optional?

Meet John and Jane, a dynamic couple in their early 40s, both directors in publicly traded companies, who faced this very challenge. This case study delves into their financial journey, outlining the challenges they encountered, the tailored strategies we implemented, and the significant improvements we achieved. Read on to discover how John and Jane successfully navigated the intricacies of financial planning to bring them closer to their ultimate goal—making work optional while securing a financial legacy for their loved ones

The Situation: John and Jane Smith

Who Are John and Jane?

Meet John and Jane, both directors in publicly traded companies—John in the aerospace industry and Jane in healthcare. In their early 40s, they have reached a stage in their careers where they are earning a combined income of just over $400,000 per year.

Financial Assets and Liabilities

In addition to their salaries, John receives Restricted Stock Units (RSUs) as part of his compensation package. This has allowed him to build up a sizable position in his company’s stock. While optimistic about the stock’s long-term outlook, John is concerned about the lack of diversification in their investment portfolio.

The couple has approximately $500,000 in investable assets, spread across group RRSPs (Registered Retirement Savings Plan), personal RRSPs, TFSAs (Tax Free Savings Account), and non-registered stock holdings.

They also own a house valued at $1.5 million, with an outstanding mortgage of around $400,000. They have two young children, and their monthly expenses average about $10,000.

Financial Management

John and Jane are diligent savers and have always maintained an updated budget. However, they have come to realize that their financial planning needs have outgrown the capabilities of a simple Excel spreadsheet. As their wealth and financial complexities have increased, they feel the need for a more sophisticated approach to financial planning.

The Challenge: What They Are Trying to Achieve

Current Advisory Relationship

John and Jane are currently working with a financial advisor affiliated with a bank. Unfortunately, the service they have received has been less than satisfactory. The advisor’s focus seems to be more on selling mutual funds rather than proactively looking for financial solutions tailored to their needs. As a result, they do not have a clear understanding of where their money is invested or what fees they are paying.

Financial Independence and Legacy Goals

The couple’s primary financial goal is to reach a point where work becomes optional. They aspire to accumulate enough capital to finance their retirement expenses without having to dip into the principal amount. Additionally, they wish to leave an estate for their loved ones, ensuring financial security for future generations.

Investment Alignment and Account Prioritization

Both John and Jane have group RRSPs through their employers. They are seeking guidance on how to align the asset allocation and investment decisions in these accounts with their personal investment portfolios, which include personal RRSPs, TFSAs, and non-registered stock holdings.

They are also grappling with the question of which accounts to prioritize for contributions. With an outstanding mortgage and other debts, they want to understand the trade-offs between paying off debt versus contributing to retirement accounts.

Stock Liquidation Strategy

John is looking to establish a framework for selling off his company stock. He wants this decision to be rooted in a well-thought-out process that aligns with their overall financial plan, rather than being based on gut feelings or market timing.

The Approach: What We Did

Comprehensive Financial Planning Projection

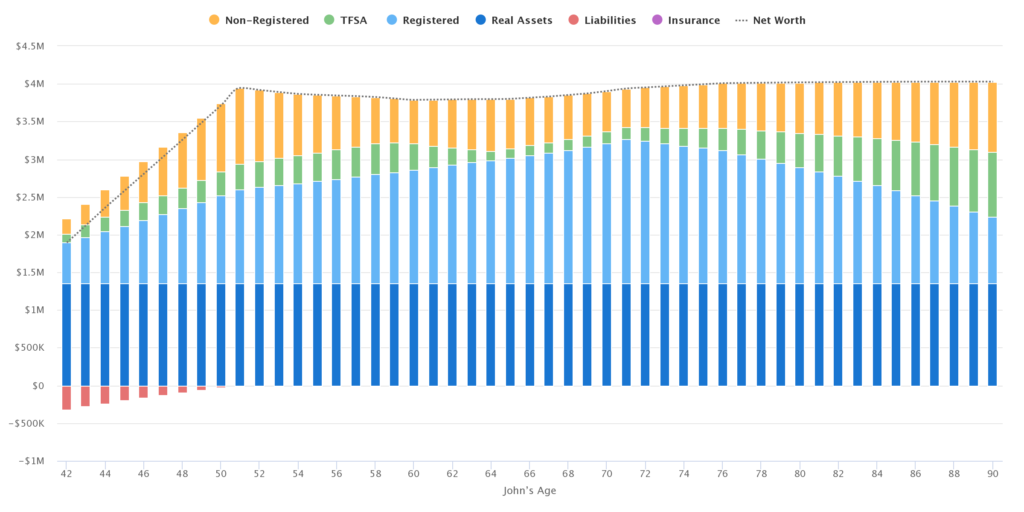

Our first step was to build a comprehensive financial planning projection based on John and Jane’s current financial circumstances. This projection served as a baseline model, enabling us to iterate and identify areas for improvement. By doing so, we gained a clear understanding of their projected net worth, adjusted for inflation, and determined the required amount of capital needed to make work optional for them.

Combined Net Worth Adjusted for Inflation

Optimal Order of Liquidation

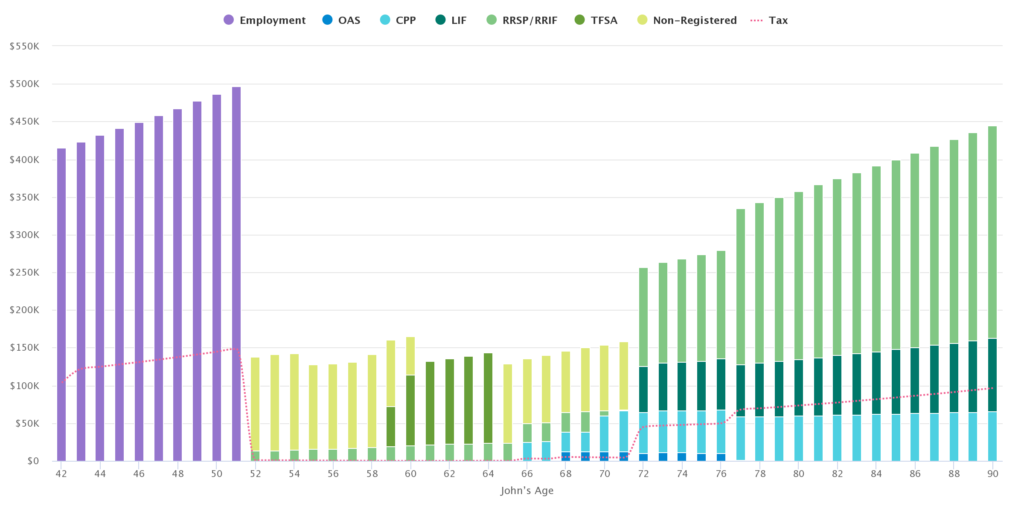

One of the key insights from our projection was identifying the optimal order for liquidating their various savings and investment accounts during retirement. This is crucial for maximizing the longevity of their assets and minimizing tax implications. Knowing which accounts to draw from first provided a roadmap for their retirement years, ensuring that they could meet their expense needs while preserving capital for their estate.

Combined Income Sources in Retirement

Investment Portfolio Modeling

Armed with this information, we were able to start modeling an investment portfolio tailored to their specific needs. This involved aligning the asset allocation in their group RRSPs with their personal investment accounts, including personal RRSPs, TFSAs, and non-registered funds. The goal was to create a balanced, diversified portfolio that could meet their financial objectives while aligning with their risk tolerance.

The Recommendation: Improvements We Brought

Asset Location Strategy

One of the first steps we took was implementing an asset location strategy. Asset location is a tax-minimization approach that leverages the different tax treatments of various types of investments. Recognizing that John and Jane’s TFSA (Tax Free Savings Account) accounts have a longer time horizon compared to their RRSPs, we shifted the more aggressive components of their portfolio into the TFSAs. Conversely, we made the investments in their RRSPs more conservative. This strategy effectively reduced the volatility of their income distributions during retirement.

Tax Minimization in Non-Registered Accounts

For their non-registered accounts, we implemented a tax minimization strategy focused on recharacterizing taxable income distributions into unrealized capital gains. We achieved this by utilizing total return passive index ETFs (Exchange Traded Funds), which are designed to minimize taxable distributions.

Liquidation of Company Stock

We also developed a strategy for John to liquidate his company stock at predetermined intervals. This approach is aligned with their overall financial plan and allows John to benefit from the stock’s future growth while minimizing the risk associated with potential market corrections.

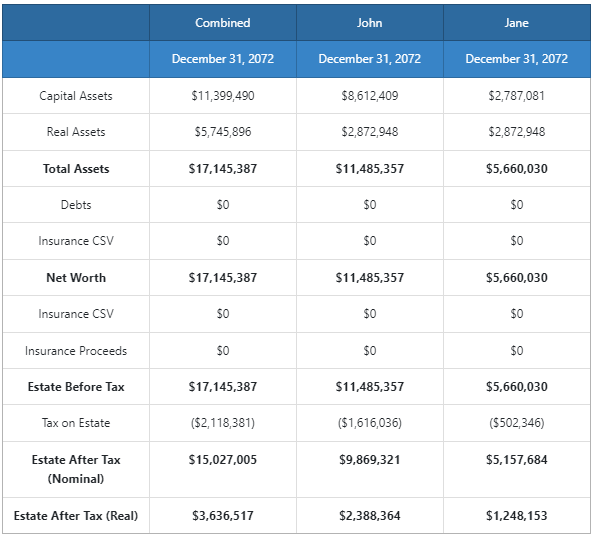

Financial Impact

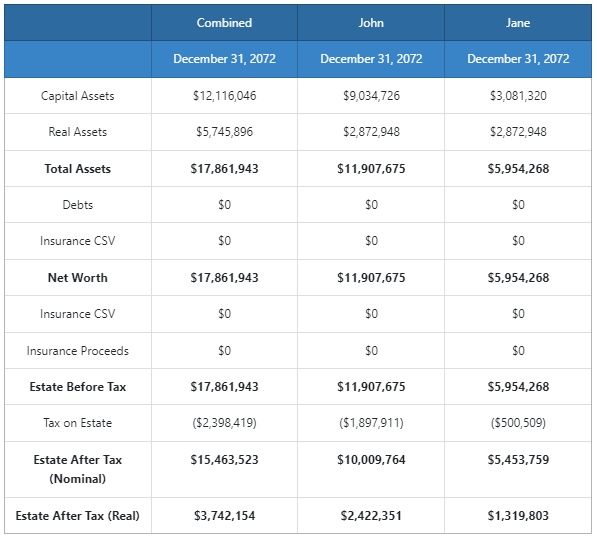

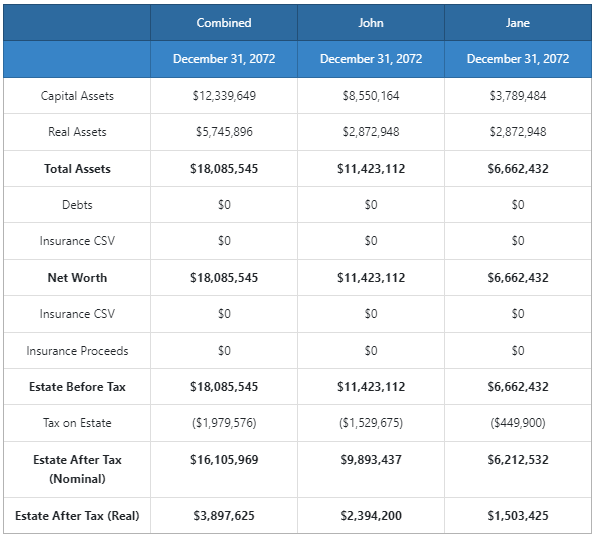

The combined effect of these recommendations led to a significant improvement in John and Jane’s financial outlook. Specifically, these strategies resulted in an inflation-adjusted increase in their retirement after-tax estate value of $261,000.

Baseline Model

Tax Efficient Portfolio

Tax Efficient Portfolio and Optimized Asset Location

Conclusion

Navigating the complexities of high-income financial planning requires more than just a spreadsheet and a one-size-fits-all approach. John and Jane’s situation exemplifies the multifaceted challenges that high-income, mid-career professionals face when planning for a future where work becomes optional.

Through a comprehensive financial planning projection, we were able to establish a baseline understanding of their financial landscape. This allowed us to identify key areas for improvement, such as asset location for tax minimization, income distribution strategies for retirement, and a structured approach to liquidating company stock.

The recommendations we implemented were tailored specifically to John and Jane’s unique financial situation and goals. These strategies not only brought clarity to their financial planning but also resulted in a significant, inflation-adjusted increase in their retirement after-tax estate value.

As a result, John and Jane are now better positioned to achieve their primary goal of making work optional, while also leaving a financial legacy for their loved ones. They have gained a newfound sense of financial security and peace of mind, knowing that their financial future is built on a solid, personalized plan.