1. Management Expense Ratio (MER)

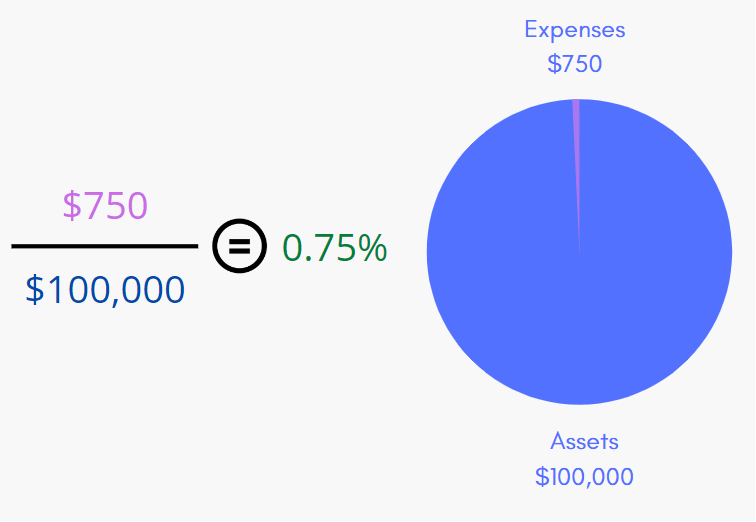

The main cost for holding a mutual fund is the management expense ratio (MER). The MER consists of various expenses including management fees, commissions, and operating expenses. It is calculated in percentage terms based on the assets the fund manages– the average dollar amount of the fund’s investments. For instance, if a fund’s annual costs are $750 and it holds assets of $100,000, the MER would be 500/100,000 = 0.75%.

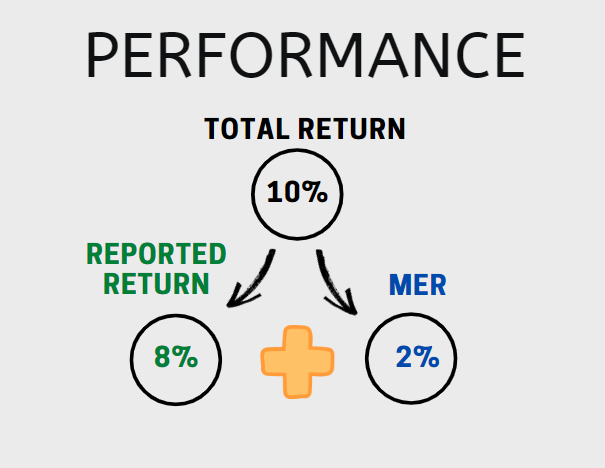

The MER is automatically deducted and not charged to investors directly. This means that the returns quoted on the investment statement are net of the MER, and there is no further responsibility from the investor’s side for their payment. Thus, a fund with a performance of 10% and MER of 2% will report to investors a return of 8%.

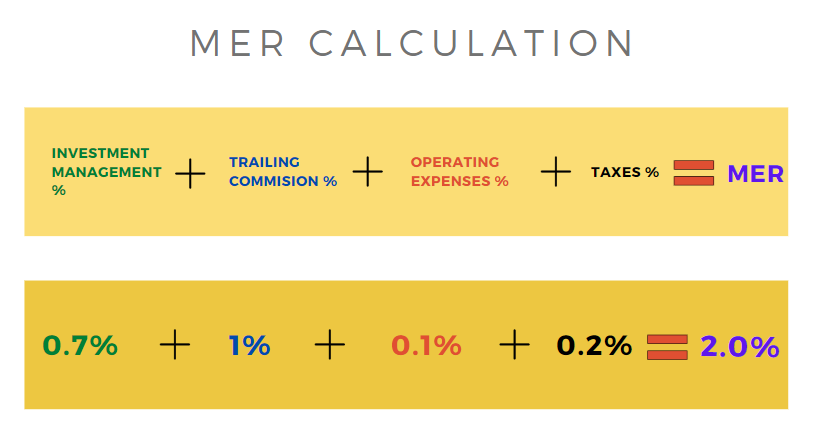

The MER accounts for investment management costs, trailing commission, operating expenses, and taxes.

- The management fees are net of investment management fees and trailing commissions. The former includes costs of hiring and compensating the portfolio management and the investment team. Mutual funds are managed by a professional team with specialized knowledge, making tailored investments with specific objectives outlined in the fund’s prospectus. Managers are extensively using different tools like market data and access to research reports for decision-making purposes. The investment management fee pays for the professional management and supervision of the fund.

- The trailing commission is a fee paid by the mutual fund manufacturer to the investment dealer who directed the investor to purchase the fund. It is an annual commission used to compensate the investment dealer for their financial advice and service to the individual. Apart from the advice, recommendations, and financial planning, the trailing commission also pays for the services performed by the dealer like trade confirmations, account openings, regulatory compliance activities among others.

- Operating expenses are day-to-day costs that a mutual fund incurs through its main operations. It may include costs like accounting and auditing, preparation of reports and prospectus, record keeping fees, interest charges.

- Mutual funds pay taxes on their revenues originating from their management and administration fees based on federal and provincial tax rates.

2. Trading Expense Ratio (TER) and Total Mutual Fund Fees

While the MER compiles all management fees and commissions, as well as other operating expenses and taxes, it does not account for trading and brokerage costs. These expenses are included in the trading expense ratio (TER). The TER consists of the commissions paid when management buys and sells securities in the portfolio of the fund. TERs are usually associated with funds that trade equities. Fixed income funds do not have TER as no commission is paid for the transfer of such assets (the commission is embedded in the bond’s price). Like the MER, the TER is calculated by taking the costs captured by the expense ratio and divided by the average assets under management. As a continuation of the previous example, the fund with assets of $100,000 which has $150 in trading expenses will have a TER of 150/100,000 = 0.15%.

Unlike the MER, the TER could vary from year to year as it depends on the trades that the mutual fund completes during the year. The TER stated in the fund’s prospectus reflects the previous year’s trading activity of the mutual fund.

The main factors that determine the size of the TER are the type of the fund, the trading activity, the fund flows, and stock liquidity.

- As already noted, the TER for fixed-income mutual funds is zero, and TER is only induced from stock transactions. All else equal, funds that focus specifically on equities will have the highest TER, while balanced funds (which invest extensively in both equity and bond markets) will have a lower TER.

- The trading activity refers to the turnover rate of the portfolio. Actively managed mutual funds will have a higher turnover rate as the investment managers are constantly buying and selling securities with the goal of achieving higher returns. As more stocks are traded by the fund, it will enter more transactions, and thus it will have higher commissions to pay for the higher number of transactions. Further, large purchases or redemptions will trigger significant fund flows that will tend to increase the TER of the fund.

- The liquidity of the stocks traded refers to the marketability of the shares. Stocks with large trading volumes and a high number of investors seeking to buy and sell the securities are deemed to be more liquid. More liquid securities are typically cheaper to trade.

While TER would generally be low or even zero for mutual funds dealing with fixed-income securities or funds with a relatively low turnover rate (like an index-linked fund), the TER could be a substantial expense for some active (usually riskier) funds with high turnover, and one should properly examine the effects it will have on a fund’s returns before investing.

The total expense of a fund is the sum of MER and TER. Both are automatically paid for, and the quoted return of a mutual fund is net of both MER and TER. For instance, a fund with 0.75% MER and 0.15% TER will have a total expense ratio of 0.75% + 0.15% = 0.90%. If the fund has a 5% net return, the return that the fund will quote (and the return that the investor will receive) will be 5% - 0.9% = 4.1%.

3. Advisor Series and Fee-Based Series Mutual Funds

The two main types of mutual funds in terms of cost structure are the Series A and the Series F funds. The major difference between the two is that the Series A charge a trailing commission as described above, while Series F omit this cost, and a fee for the service of the investment dealer is separately negotiated and paid directly by the investor. This means that the management fee of the Series F funds consists only of the investment management compensation, which effectively reduces the MER. The services by the dealer for advice, access, and service are paid separately from the MER. Due to the exclusion of the trailing commissions from the management fees, the taxes paid (as included in the MER) will also be lower.

Fee-based funds result in higher transparency of costs as investors can identify the different components of their fees. Series F fund continually disclose the exact fee paid to the dealer, while Series A usually only submit a breakdown of the costs once a year in their annual report. Series F funds can also lead to personalized pricing as the fee is based on the specifics of the investor’s account. It may further allow for fee grouping with assets of multiple members of the same household or family, and these fees are tax-deductible if the fund is not held in a registered account like an RRSP.

In the general case, however, since a commission for the investment dealer would be paid regardless of whether it is explicitly included in the MER of a Series A fund or paid separately as for Series F funds, the total return for the investor would be (approximately) the same. The Series A fund is still the preferred type of Canadian investors as per data from Morningstar[1]. Yet, a gradual shift towards fee-based funds is expected due to the new regulations of 2021 known as Client Focused Reforms, which focus on improving the service provided to investors through the know-your-client, know-your-product, and suitability requirements.

4. Where to Find the Management Expense Ratio

The management expense ratio could be found in multiple places:

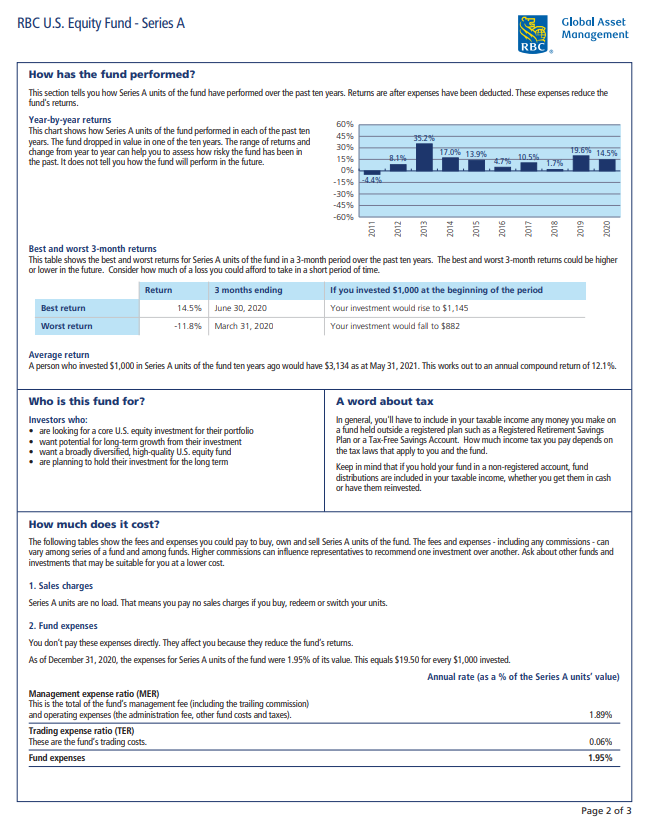

- The quickest and easiest way to find the MER is to look in the Fund Facts document. Fund Facts document provides the MER in the quick facts section, and it discloses both MER and TER in the cost of buying, owning, and selling the fund section along with any other costs and fees the fund could charge.

- The company managing the mutual fund will often disclose the MER on its website. Companies list their offered mutual funds, usually accompanied by some key facts including the MER, the management fee, the type of the fund (A or F Series), asset types, level of risk.

- The Management Report of Fund Performance (MRFP) provides in-dept information about the fund, including its MER, its strategic objectives, risks, and significant assets holding.

- The simplified prospectus, which is delivered to the investor upon request, also includes the MER along with other key information about the fund.

5. Examples of Fund Fact documents

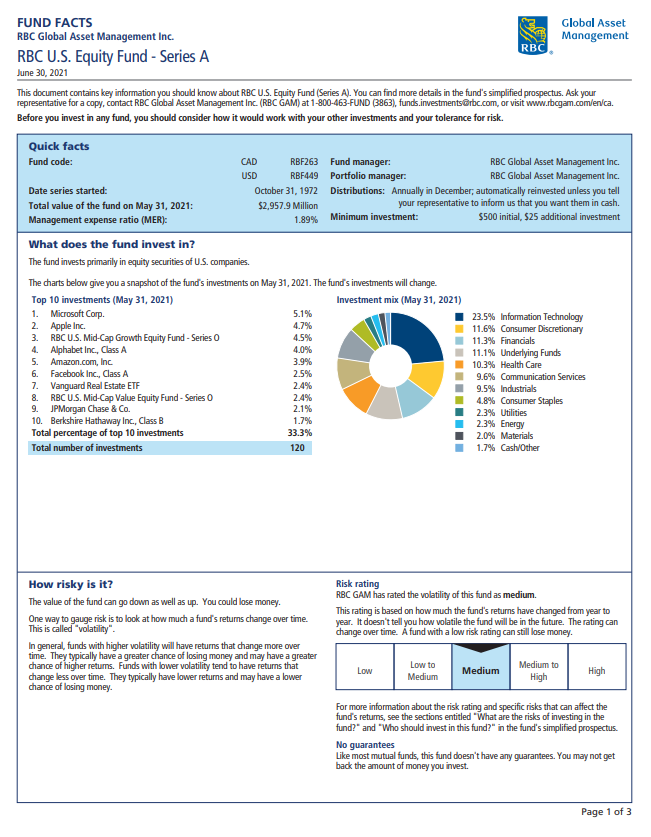

The Fund Fact document is a regulatory required disclosure document informing the investor about key facts about the fund. It should be short (less than 4 pages), written in an easy-to-understand format, and delivered to investors pre-purchase. The Fund Fact document consists of two sections. The first section consists of an introduction, quick facts, investments of the fund outlining a list of the top ten investments, risks, past performance, suitability for investors, and an impact of income taxes on investor returns. The second section focuses on the cost of buying, owning, and selling the fund, statements of rights of the investors, as well as more information such as contact information.

Below you can find an example of a Fund Facts document of the RBC U.S. Equity Fund Series A (fund code: UBF263):

Figure 1. RBC U.S. Equity Fund Series A (UBF263)[2]

6. Average Fees in Canada

The main determining factor for the TER is the trading activity of the mutual fund. The MER, however, is impacted by various factors like the level of expertise of the management team and the type of mutual fund. Money market funds (funds investing in bonds maturing in less than a year) tend to have the lowest MERs typically ranging from 0.5% to 1%. Actively managed equity funds will have the highest MER of about 2% to 3%.

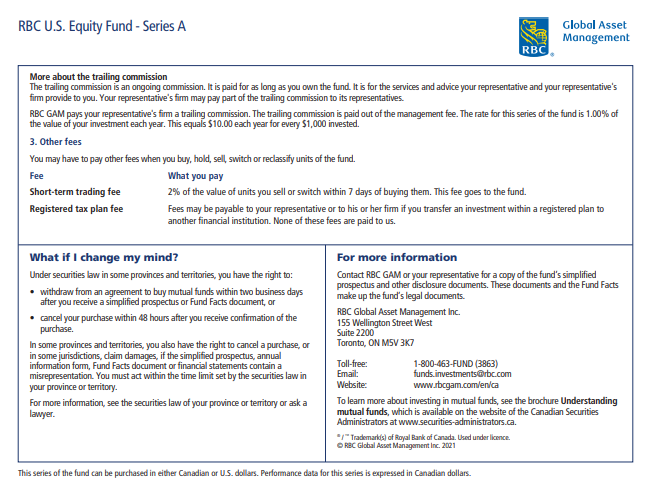

Historically Canadian mutual funds have very high MERs. The average equity MER in Canada is about 2.23%, while in the U.S. it is just 0.66%[3]. Figure 2 below exhibits the differences in MER among multiple developed economies around the world, and Canada’s rates are the highest for allocation funds (funds consisting of multiple asset classes like stocks and bonds) and among the highest for equity funds in the given sample. The major reason for such results could be the environment of the Canadian market which is dominated by a few large players that charge high rates in an oligopoly-like economic structure. In contrast, the high competition in the American market has pushed these rates much lower.

Figure 2. Asset-weighted median expense ratios for Allocation funds (on the left) and Equity funds (on the right)[4]

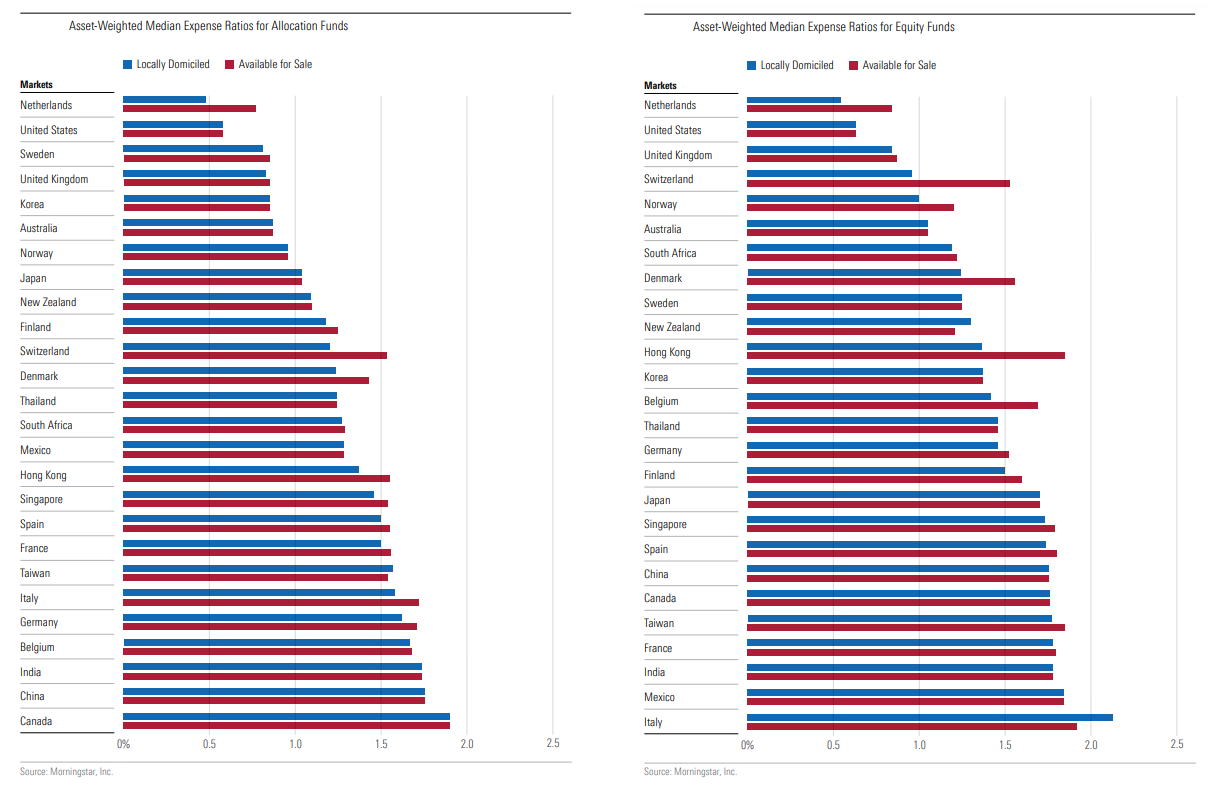

7. Impact of Fees on Investment Growth

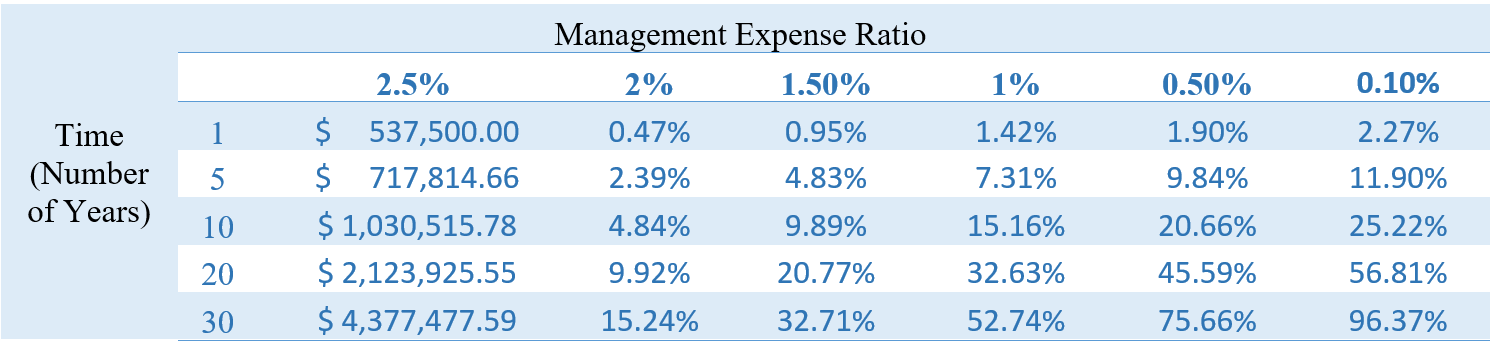

Many Canadians tend to neglect small differences in the MER. However, a small change in the MER could have a huge impact on the long-term returns of an investment due to the compounding effects. Table 1 below depicts the vast differences in returns of a $500,000 investment assuming a constant unadjusted return (before deducting the MER) of 8% over different investment horizons. It shows the dollar return of a fund with a 2.5% MER and the percentage increase in capital caused by a small decrease in the MER. One could see that even a small 1 percentage point difference in MER for a 30-year investment could lead to over 30% more total capital (initial investment + return) in the investor’s account. Figure 3 also graphically depicts the divergence of returns between the different MER rates as the investment horizon increases.

This analysis highlights the importance of MER in the decision-making process of choosing a suitable mutual fund. Investors should weigh their goals and examine the differences in MERs to find their optimal investment so that they do not lose a huge part of their return due to high MERs.

Figure 3. Return on a $500,000 investment with an 8% compounded annual return

Table 1. Percentage increase of total returns on a $500,000 investment with an 8% compounded annual return relative to the capital return with 2.5% MER

8. Conclusion

The choice of a mutual fund may seem daunting, but with some proper research and cost considerations, one can find the best choice easily. Apart from considering the investment horizon, objectives, and the level of risk that one can accept, an investor should carefully examine the costs associated with the mutual funds. As represented in this article, a small difference in the expense ratio could have a significant effect on the long-term returns of the investment. Thus, it is recommended that investors pursue mutual funds with lower MER.

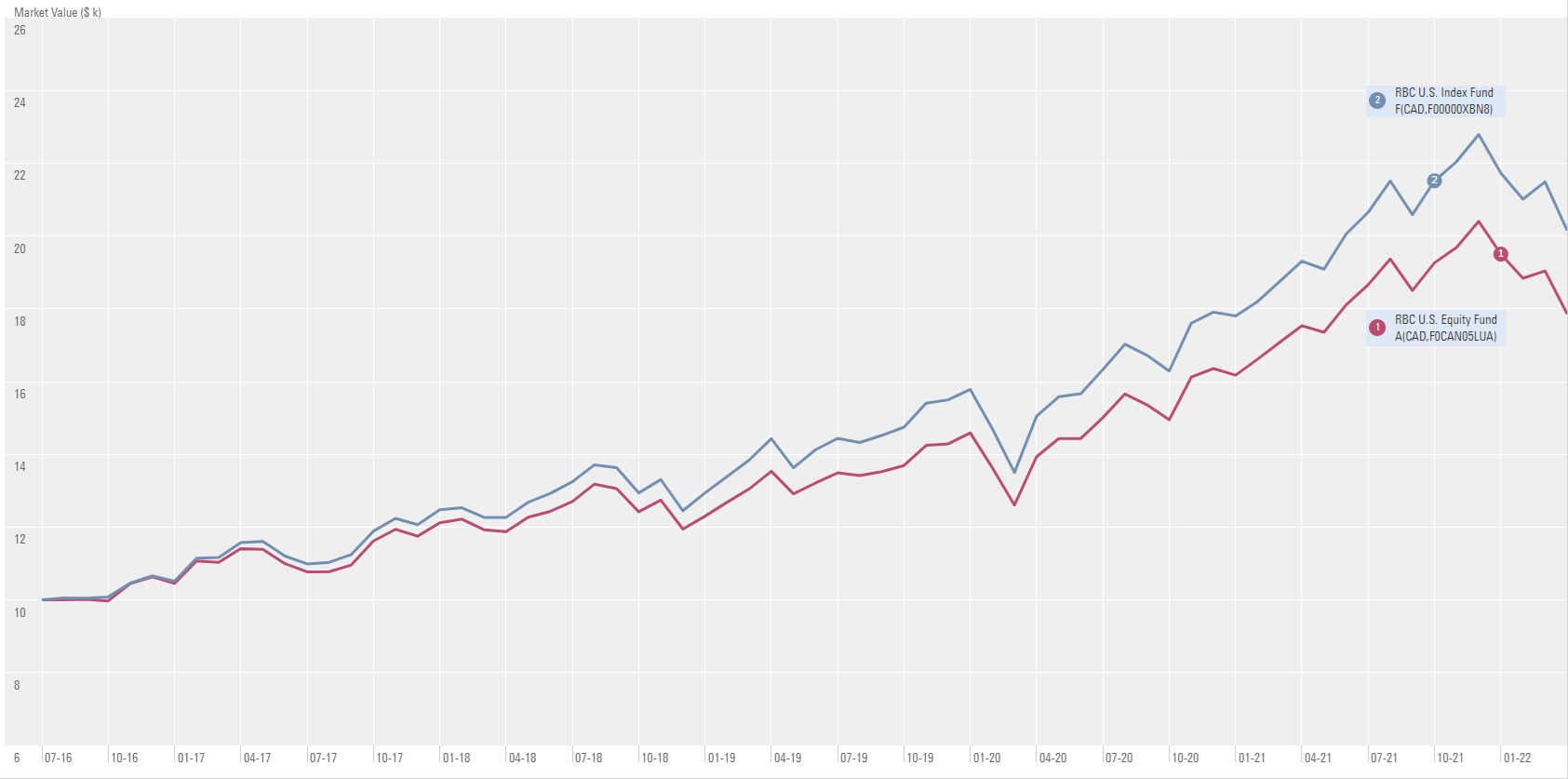

The funds with the highest MER are usually equity funds. Index-linked funds, however, usually invest in similar assets and carry significantly lower fees. Index-linked funds are mutual funds that fully replicate a market index like the S&P 500 or S&P/TSX 60. Thus, these funds consist of a diversified portfolio of usually large capitalization blue-chip stocks. Since equity funds invest in many of the stocks of the index, the performance of the two types of mutual funds would be analogous. For instance, the asset composition and the returns of the RBC’s U.S. Index Fund (RBF5737) and U.S. Equity Fund (RBF263) are very similar, yet the management fee is 1.6% (MER of 1.89%) for the actively managed fund and only 0.09% (MER of 0.21%) for the index fund. This effectively makes the total return of the investment in the index fund higher as shown by Figure 4 below.

Figure 4. Investment growth of RBC’s U.S. Index Fund (blue line) and RBC U.S. Equity Fund (red line)

Another advantage of index funds is that they will generally have lower TER since they do not actively trade stocks, and the only trades that may occur would be a rebalancing to the initial asset mix as prices and company valuations change. For example, the RBC U.S. Index Fund has a TER of 0% (compared to a TER of 0.06% for the U.S. Equity Fund).

Thus, retail investors are encouraged to pursue a more passive, index-linked investment, which will generally have similar net returns as a comparable equity fund, yet the MER and the TER will be lower, which could materially improve the long-term performance of the investor’s investment.

Author: Alexander Natchev

[1] Morningstar. “Global Investor Experience Study: Fees and Expenses.” 2022, pp. 11–12.

[2] RBC U.S. Equity Fund Series A, 2021

[3] Omololu. “The Many Faces of Investment Fees in Canada.” Savvy New Canadians, 2022

[4] Morningstar. “Global Investor Experience Study: Fees and Expenses.” 2022, pp. 11–12.