A few years ago, Wall Street Journal finance columnist Jason Zweig shared an interesting three-part rule, relayed to him by his father, about the different ways one can get paid in life. It goes like this:

There are three ways to make a living.

1) Lie to people who want to be lied to, and you’ll get rich.

2) Tell the truth to those who want the truth, and you’ll make a living.

3) Tell the truth to those who want to be lied to, and you’ll go broke.

This wisdom has stuck with me over time because it is particularly relatable to the business of investment management where fortunes have been made by promising what can’t be delivered. I refer specifically to the practice of selling market-beating returns. I’ve written on the evidence that beating the market is next to impossible, but this wouldn’t necessarily mean that a portfolio manager who claims that he has the secret sauce is being disingenuous.

After all, there is still a small proportion of active managers who generate investment returns better than the market consistently. To be precise, at the end of 2021, 5.68% of Canadian equity mutual funds had beaten the S&P/TSX Composite Index over the preceding 5 years. That’s a terrible track record, but it’s not necessarily proof that these mutual funds set out to deceive investors. After all, there’s no shame in doing your best even if you come up short in the end. However, repeatedly failing at your stated mandate while incessantly marketing to new investors is certainly problematic.

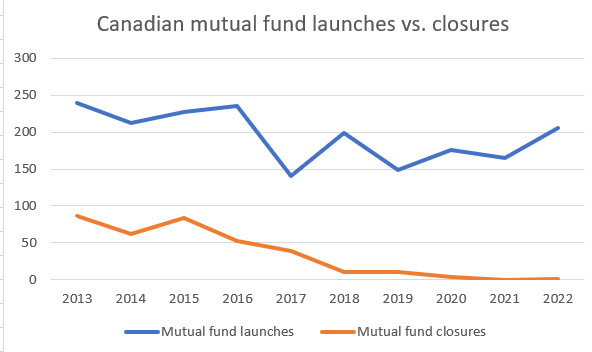

Over this 5-year period of constant underperformance, the number of mutual fund closures fell every single year. Unbelievably, there was not a single fund that closed in 2021! As a matter of fact, the Canadian mutual fund industry saw over $114 billion in net flows that year.

In the meantime, a new study exploring the views of the active investment community in the UK and the US regarding the rise of passive indexing was published. Perhaps not surprisingly, it concluded that for the most part mutual fund managers neither invest their own money in the funds they run, nor believe in their ability to beat the market.

Some of the interviewed were highly critical of the mutual fund industry.

“The amount of ignorance on the buy-side is mind blowing,” said one,” and that’s one of the big reasons why I think there is no alpha generation happening (and) why the industry is moving towards passive. The industry (is) made up of very average people who just don’t know what they are doing.”

A second interviewee described how a “top fund manager” was barely able to use a computer, still kept a paper diary, and insisted on his PA printing out a paper copy of any research he wanted to read.

“I don’t see any reason why this trend towards passive management won’t continue,” said a third interviewee. “All my own money is in index funds.”

These are damning findings, and while it’s not exactly clear why investors continue to throw good money after bad money at these funds, it is pretty simple why funds continue promoting performance knowing fully well they can’t deliver. The financial incentive is just too strong. Take for example Fidelity’s Johnson family whose net worth is shy of $50 billion. Lie to people who want to be lied to, and you’ll get rich.

Compare this to Jack Bogle, the Vanguard Group founder and father of the index fund. He transformed investment management, democratizing investing by making it cheaper and more accessible to the retail investor. Remarkably, Bogle created billions of dollars in value for others and kept a small fraction of it for himself. When he passed away at the age of 89 four years ago his net worth was $80 million.

Today Vanguard has tens of ETFs available to Canadian investors. The Vanguard FTSE Canada All Cap Index ETF is one of their most popular offerings. It has beaten the performance of nearly every single actively managed fund that invests in Canadian equities, and it only costs 0.005%. With assets under management of over $5 billion, the fund is still generating $2.5 million in revenue for Vanguard – not enough to get rich, but enough to make a living.