During volatile times some investors will naturally get the itch to sell at a loss. In the bear market we are going through this is even more pronounced as cash is finally paying a reasonable interest rate while bonds, which are supposed to provide safety in times precisely like these, are taking a monumental beating.

As a result, investors have lost interest in both equities and fixed income in lieu of holding cash in money markets, savings accounts and term deposits.

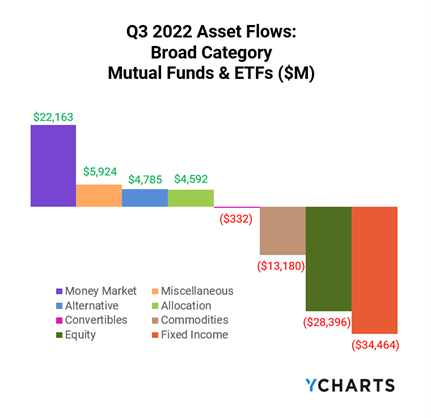

The chart below shows last quarter’s US fund flows out of fixed income and equities into money market and alternative funds.

Source: Nasdaq

The situation in Canada is not much different. Ryal Bank of Canada executives said on the company’s earnings call last week that roughly $25 billion of customer funds has flowed into GICs over the past few quarters.

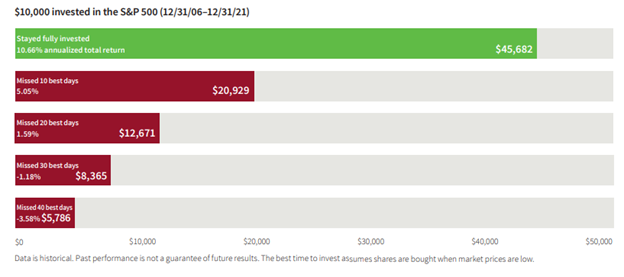

As a result, both in social and regular media, investment management firms and investment advisors have been reminding investors that time, not timing, is the best way to capitalize on stock market gains. By trying to predict the best time to buy and sell, one would miss the market’s biggest gains. One way to portray the point is to examine what the investor’s returns would be if he missed some of the market’s best trading days.

Source: Putnam Investments

I’ve seen a number of iterations of this chart produced by pretty much every large financial institution over the past year, and while I tend to agree with the general conclusion, I think it misses an important point. You can’t compare the result of missing the best days without assessing what would happen if one missed the worst days in the market.

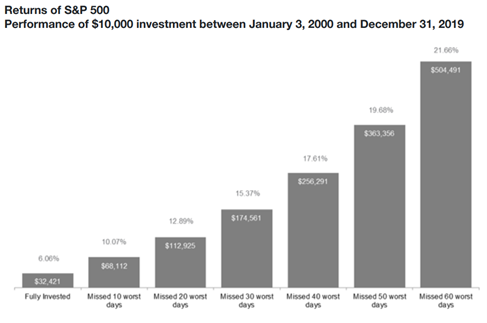

After all, selling during volatile times suggests that investors fear the bad days more than they value the good ones. This is likely due to loss aversion – the tendency to prefer avoiding losses over acquiring equivalent gains. However, it could also be a rational evaluation that missing the worst days in the market leads to outsized returns. One of the more compelling aspects of investing is the math of gains and losses. Very simply, a 50% gain does not allow a portfolio to recover from a 50% loss. In fact, 100% gain is required to restore a 50% loss. If we take this math into account, missing the worst days in the market should lead to better results than participating in the best days.

The chart below illustrates exactly this. Missing some of the worst days in the market leads to better returns than staying fully invested.

Source: American Association of Individual Investors

This is not to say that I embrace market timing, but rather that the investment industry’s “stay invested at all times” message is misguided. Firstly, it understates the impact of avoiding large losses, and secondly it entirely misses why investors sell in times of distress. They don’t care about the best days as much as they want to avoid the worst days. And the math is on their side.

More importantly, if by some miracle you managed to miss the 20 best days, you likely would have missed at least some of the worst days as well. This is because the best and worst market days tend to be clustered together.

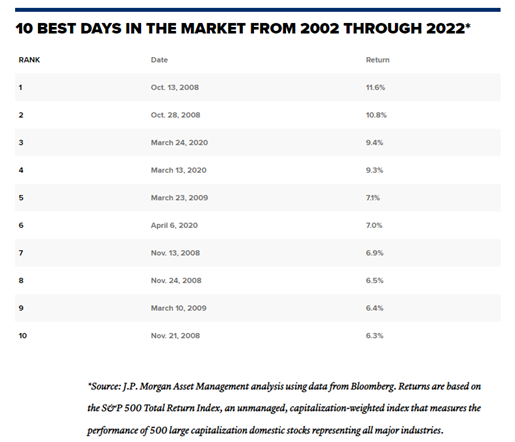

The table below shows the 10 best days for the S&P 500 in the past 20 years.

Notice that they all occurred in the two massive crashes we experienced in this period. In addition, the worst days overwhelmingly occur before the best days. From January 3, 2000 to April 19, 2020 six of the seven best days occurred after the worst day. Seven of the ten worst days were followed the next day by either top 10 returns over the 20 years or top 10 returns for their respective years.

This year is no exception. As of the publication of this blog, September 13 was the worst day for the S&P500 when the market dropped 4.32%. The best day in 2022 so far was November 10 when the S&P500 jumped 5.5%. In less than a month we saw both the best and the worst 2022 had to offer.

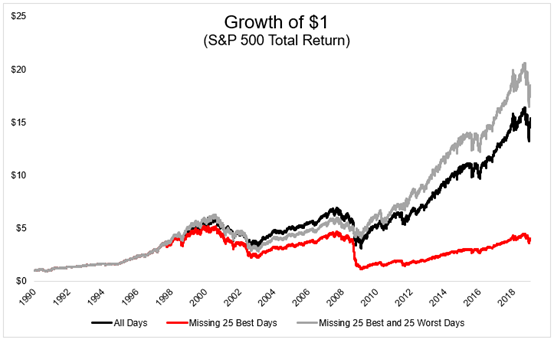

The real question we should be asking is not what happens if one misses the best or the worst trading days. They happen so closely next to each other that it is safe to say that is impossible to time them. Rather, what matters is how a portfolio would perform if an investor avoided both the worst and the best market days. The chart below gives us the answer.

Source: The Irrelevant Investor

Missing both the best and the worst days generated returns better than staying fully invested. This is not surprising given that most of the best days occurred during the worst years for the market when one would have been better off staying in cash.