The rise in interest rates in 2022 led to an increase in the cost of borrowing and as a result to the repricing of financial assets ranging from equities and bonds to real estate. Higher long-term rates also had a collateral effect on an asset type that is rarely discussed in media – the commuted value of pension benefits in a defined benefit pension plan.

An increase in prevailing interest rates has a negative effect on the commuted value of a pension as less funds are required to purchase or pay the monthly pension the employer has promised the potential pensioner. This inverse relationship between interest rates and cumulative pension values incentivized many pensioners, who were given the option, to commute their pensions in the last few years.

In 2017 Financial Post columnist Ted Rechtshaffen referred to the low interest rate environment at the time as a golden opportunity to commute a pension that could soon slip away.

“The key interest rate for most Canadian pensions is the Bank of Canada five-year bond yield. This is often the number used to help calculate your commuted pension value. On Feb. 10 2016, the five-year yield hit an all-time low of 0.41 per cent. That was the best day for a commuted value pension (or best month as they are usually valued monthly).”

He was right, although in hindsight, there was an even better opportunity to commute a pension when in 2020 the five-year bond yield dropped slightly under its 2016 low.

Now that rates have risen sharply over the past year, people who were expecting to take a lump sum payment instead of a monthly pension from their defined benefit plan have seen the commuted value of their pension decline significantly.

But does this mean that commuting doesn’t make sense anymore?

What is commuted value and how is it calculated?

Commuted value represents the lump sum of funds equivalent to the pension one would otherwise receive as a monthly payment for their lifetime upon retirement. Commuted values are calculated using the present value of the future stream of payments from the pension. The calculation is based on assumptions prescribed under the Pension Benefits Act.

Generally speaking, the value of a defined benefit pension is contingent on yields on Government of Canada bonds and hence can change from month to month. When interest rates decrease, the commuted value of a pension goes up, and vice versa - when interest rates increase, the commuted value will decrease. In this sense, a higher interest rate means one would have to set aside less today (a lower commuted value or present value) to earn a specified monthly income in the future.

For example, consider a pension that has one payment of $10,000 at the end of the year.

- If the interest rate is 1%, the commuted value of this payment today would be 1/1.01*10,000 = 9,900.99.

- If the interest rate is 5%, the commuted value of this payment today would be 1/1.05*10,000 = 9,523.90.

A rate increase of this magnitude could cause quite a sticker shock for a pensioner looking to commute their pension. Multiplied by a 30-year life expectancy, the above calculation could lead to a commuted value drop in the hundreds of thousands.

Maximum Transfer Value and Cash Component

When commuting a pension there is a calculation that determines how much of the total commuted value can be transferred to a LIRA or an RRSP. This is called the Maximum Transfer Value (MTV). In many cases, the maximum transfer value imposed by the Income Tax Act will prohibit the full commuted value of the pension from being transferred to a LIRA.

The MTV is based on the lifetime retirement benefit per year and the age of the pensioner. It will not be subject to income tax because it is rolled over into a registered account, but everything above the MTV will get taxed at one’s marginal tax rate.

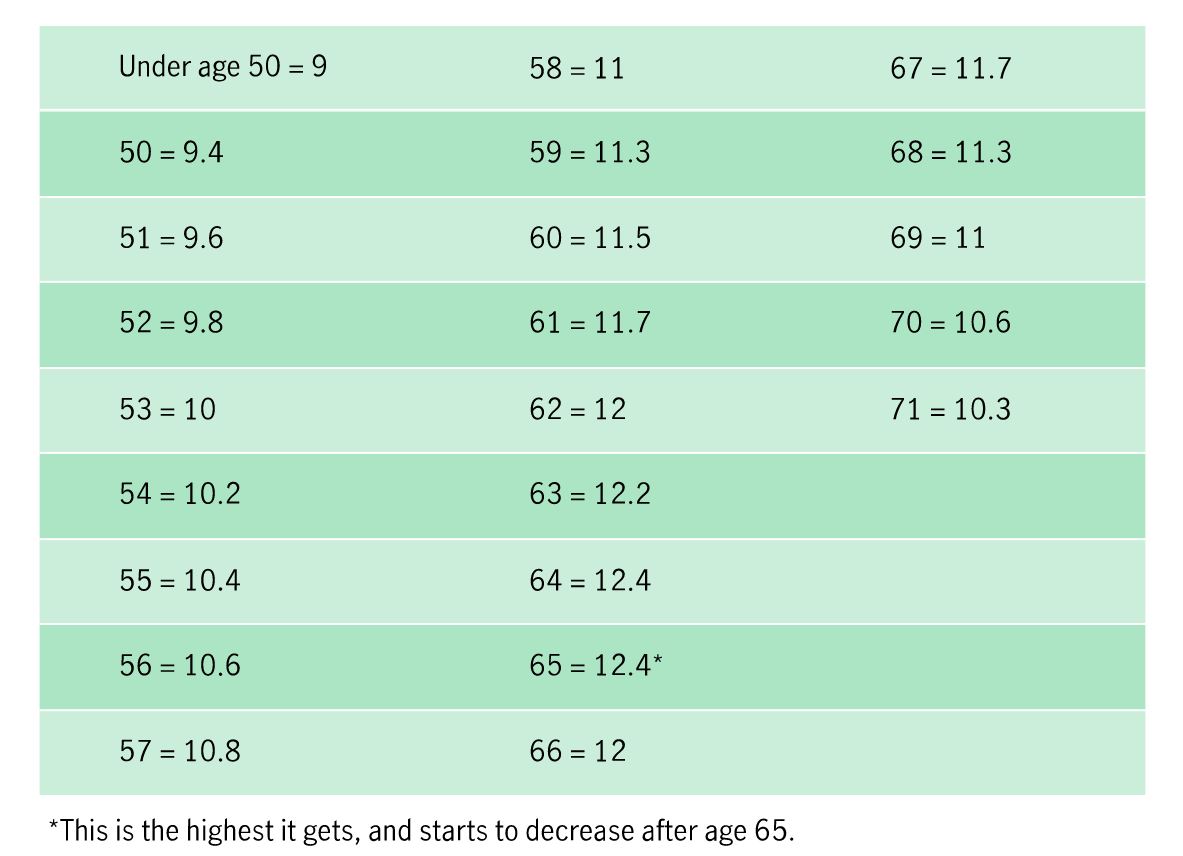

Below is a table outlining how the MTV is calculated.

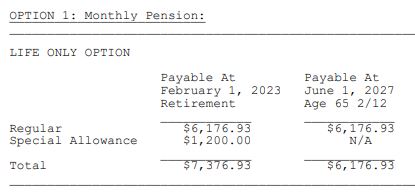

For example, if one retires at 61 with a pension that would pay $6,176.93 as illustrated here, the MTV of the pensions would be roughly 6,176.93*12*11.7 = 867,241.

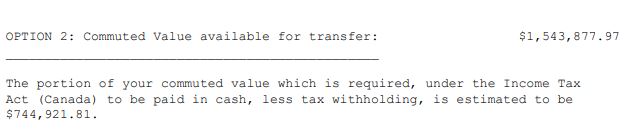

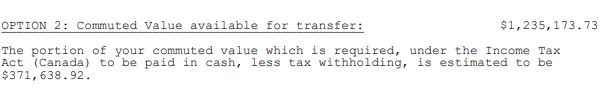

For this same pension, the commuted value available for transfer would be significantly over $1,000,000 which would make a large part of it taxable in the year the lump sum is taken.

It is not uncommon for a quarter or even half of the commuted value to be paid out in cash and taxed at the highest marginal rate. For large commuted values, this could lead to hundreds of thousands of dollars of tax payable.

Of course, some of this can be avoided with an RRSP contribution, but generally the after-tax value could be much lower than the commuted value number quoted by the pension carrier.

Case Study

This difference in the value of the pre-tax amount of the pension commuted value and the after-tax amount is one of the main factors a pensioner must take into account when making the decision whether to commute their pension.

In the low interest rate environment of the last few years, the commuted value of a defined benefit pension ballooned, but this growth was reflected in the cash component of the lump sum payment.

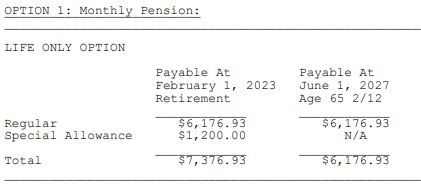

Let’s look at a real-life example. John worked for a large automaker for nearly 30 years and has been thinking about retirement for a while. In 2021 he received a statement for the value of his pension if he were to retire on March 1, 2022. At the time, interest rates were near their historic lows so the portion of the commuted value payable in cash was very significant. His options looked like this:

If he were to commute the pension, he would receive $798,956.16 in a locked-in retirement account (LIRA) that would be tax deferred, and he would be taxed on the balance. The tax payable would be $359,223, leaving him with a net of $1,184,654.97.

This was very tempting, but given John’s low risk tolerance and the low yield he would receive from a risk-free investment at the time (the average rate paid by banks to individuals on deposits at the time was 0.25%), he decided to postpone his retirement by an extra year.

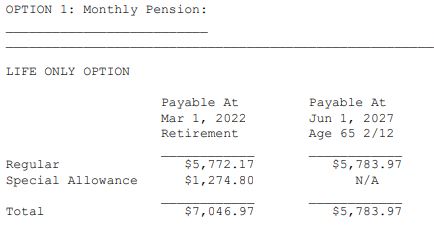

Unfortunately, by the time he retired, interest rates had jumped, and the commuted value of his pension had dropped as illustrated below.

The monthly payment went up a bit given that John worked an extra year, while the commuted value tumbled.

However, the maximum transfer value didn’t change materially (it went up along with John’s monthly pension) which meant that if John were to commute the pension, he would receive $863,534.81 in a LIRA and the balance would be taxed. The tax payable would be $159,406, leaving him with a net of $1,075,767.73. This is a decrease of 9% relative to the net value of the pension while rates were low. Of course, this is a painful pill to swallow, but at the time of the writing of this blog post the prevailing average deposit interest rate is 4.6% giving John a much higher risk-free yield than what would be available previously.

Another way to think about the decrease in the net value of the lump sum payment is in comparison to capital markets. If John commuted his pension in 2022 and invested the proceeds in a balanced portfolio of stocks and bonds, he would have suffered a loss of at least 10% in the following 12 months. He would have ended up in the same place he would be if he commuted the pension a year later.

Conclusion

Commuting a defined benefit pension made a lot of sense over the past 10 years while interest rates were low. However, the growth in the lump sum payable from a defined benefit pension was entirely realized outside of the maximum transfer value for large pensions which meant this growth came with a hefty tax bill. Nowadays, the commuted value of defined benefit pensions has declined significantly, but the decline is partially offset by the lower tax payable on the amounts above and beyond the maximum transfer value of these pensions. What is more, today retirees have many more options to invest the lump sum proceeds of their pensions in conservative and risk-free assets with much higher yields than were available a year ago.