Introduction

In the evolving landscape of financial planning, the case of Jack and Jill offers insightful perspectives on retirement income planning and investment strategy for individuals approaching their golden years. Both 52, with established careers and nearing the end of their mortgage obligations, Jack and Jill stand at a pivotal juncture. They face the universal challenge of ensuring a comfortable retirement while maintaining their lifestyle and fulfilling family obligations.

This case study delves into their unique financial situation, analyzing their income sources, assets, liabilities, and investment portfolio. We explore the nuances of their retirement goals, the inherent challenges they face, and the strategic approaches required to navigate these complexities. Our goal is to create a retirement plan that not only addresses their immediate financial needs but also anticipates future requirements, thereby ensuring a stable and secure financial future.

The Situation

Who are Jack and Jill?

Jack and Jill, both 52 are dedicated parents, each with successful careers. Jack is an established executive in the logistics industry, while Jill has built her career as a nurse. As parents to three children aged between 16 and 20, they have navigated the complexities of balancing professional and family responsibilities with commendable finesse.

Incomes and Expenses

Jack’s role in logistics brings in an annual income of about $220,000. Jill’s nursing income is around $100,000 annually. As they approach retirement, their income structure is set to change. Jill plans to retire at 56, drawing an unreduced pension from HOOPP of $65,000, and Jack aims to transition to a consulting role at 57, expecting to earn around $100,000 annually until he is 64. Their expenses have been well-managed, with a focus on saving for their children’s education while maintaining their lifestyle, the upkeep of their home, and occasional leisure pursuits.

Financial Assets and Liabilities

Jack and Jill’s financial portfolio is significantly bolstered by their family home. Despite current market conditions, they confidently estimate its value at around $2,000,000. This assessment is largely attributed to the numerous renovations and improvements they have made over the years, which have not only enhanced the home’s comfort and functionality but also its market value. The house stands as the core component of their net worth.

In addition to this primary asset, they have been proactive in planning for their children’s education, with $200,000 strategically invested in Registered Education Savings Plans (RESPs). Their first and second children are already in university, and they estimate that the RESP account will be sufficient to finance all three kid’s education.

Jack has also been planning for retirement and has been trying to contribute as much as possible to his registered accounts. His portfolio includes $700,000 in a mix of group and self-directed Registered Retirement Savings Plan (RRSP) accounts, complemented by $60,000 in a Tax-Free Savings Account (TFSA). These holdings are poised to be the engine of their retirement income in the future as Jill has no personal investment accounts

Regarding liabilities, their financial commitments are minimal, with the mortgage on their home being the primary concern. Currently, they have a remaining mortgage balance of $57,000, which they are on track to fully pay off within the next two years. This imminent mortgage completion represents a significant step towards financial freedom as they edge closer to retirement.

Financial Management

Jack and Jill have always been diligent savers, a trait that has served them well in their financial journey. They entrusted their finances to an independent advisor who, over the years, has successfully grown his practice. However, as the advisor expands and delegates responsibilities to support staff, there is a noticeable change in the personal attention Jack and Jill once received. The support staff, unfamiliar with their history and preferences, are yet to build a rapport with them.

Compounding this situation is the fact that their advisor, being about the same age as Jack and Jill, is also nearing retirement and seems to be gradually disengaging from the business. A notable concern is the advisor’s adherence to an investment strategy built around opaque and costly mutual funds, which has not evolved in the two decades of their association. This static approach may not align well with the evolving financial landscape and Jack and Jill’s impending retirement needs.

As Jack and Jill approach retirement, their primary goal is to ensure a stable and comfortable lifestyle that aligns with their long-term aspirations. Central to their retirement plan is the desire to continue residing in their family home, which they value at approximately $2,000,000. However, they recognize that maintaining such a significant asset will entail ongoing and potentially escalating expenses.

Balancing Lifestyle and Home Maintenance Costs

Currently, their annual after-tax expenses stand at $165,000, a figure they expect to reduce to about $135,000 once Jack begins his consulting work at 57. While this adjustment reflects a transition to a lower expense lifestyle in semi-retirement, they are cognizant that the costs associated with the upkeep of their home could impact these projections. The maintenance of their house, while essential to preserving its value and their quality of life, adds a layer of complexity to their financial planning.

Long-Term Financial Planning with Variable Expenses

Jack and Jill anticipate a natural decrease in personal consumption as they enter their 70s. Concurrently, they wish to support future generations, potentially assisting with expenses related to grandchildren, such as childcare and education. This duality of decreasing personal spending but increasing family support spending necessitates a nuanced financial strategy. They aim to keep their overall expenditure relatively stable in real terms, factoring in the maintenance costs of their home and their desire to contribute to their family’s future needs.

Summary of Goals

- Home Retention and Maintenance: A key aspect of their plan is not just to stay in their family home but also to manage the associated maintenance costs effectively.

- Expense Management: Strategically transitioning from current expenses of $165,000 annually to $135,000, while accounting for the increased costs of home maintenance.

- Future Family Support: Preparing to financially assist future generations, balancing this with their own retirement needs.

The challenge for Jack and Jill lies in developing a retirement strategy that accommodates their immediate and long-term financial needs, ensuring comfortable living standards and the ability to support their family, all while managing the significant expenses associated with their home.

The Approach: Comprehensive Financial Plan and Risk Identification

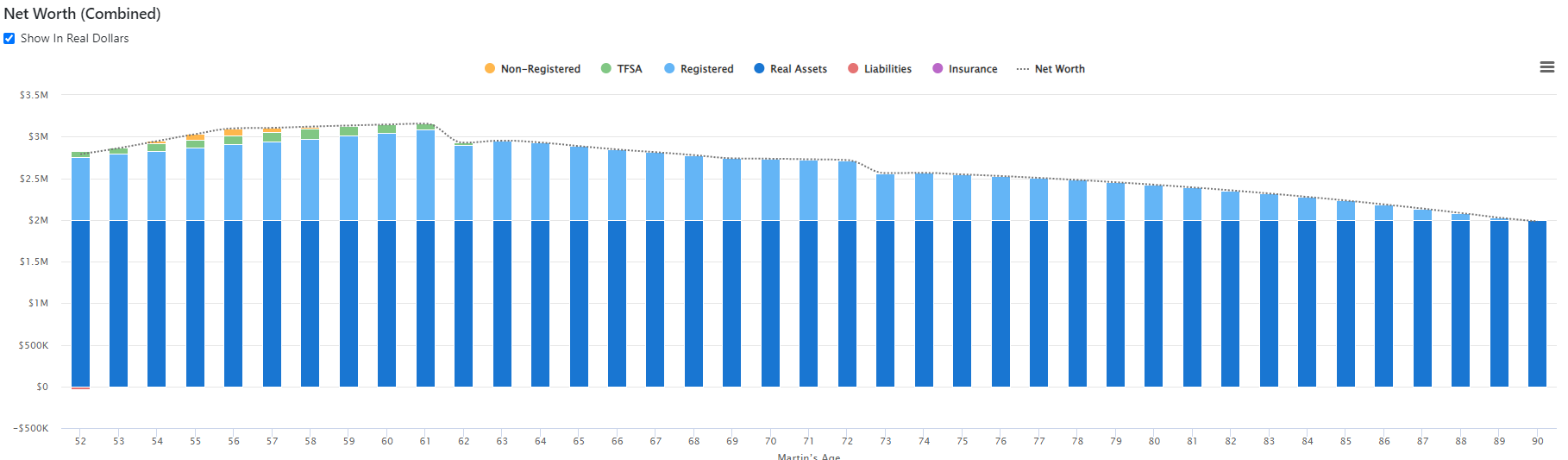

In addressing Jack and Jill’s retirement planning, we undertook a comprehensive financial planning process. This approach included an in-depth review of their income sources, expenses, tax liabilities, and investment portfolios. The resulting plan, illustrated with a detailed graph, highlights two primary issues affecting their retirement security: tax implications on their income and the sequence of returns risk.

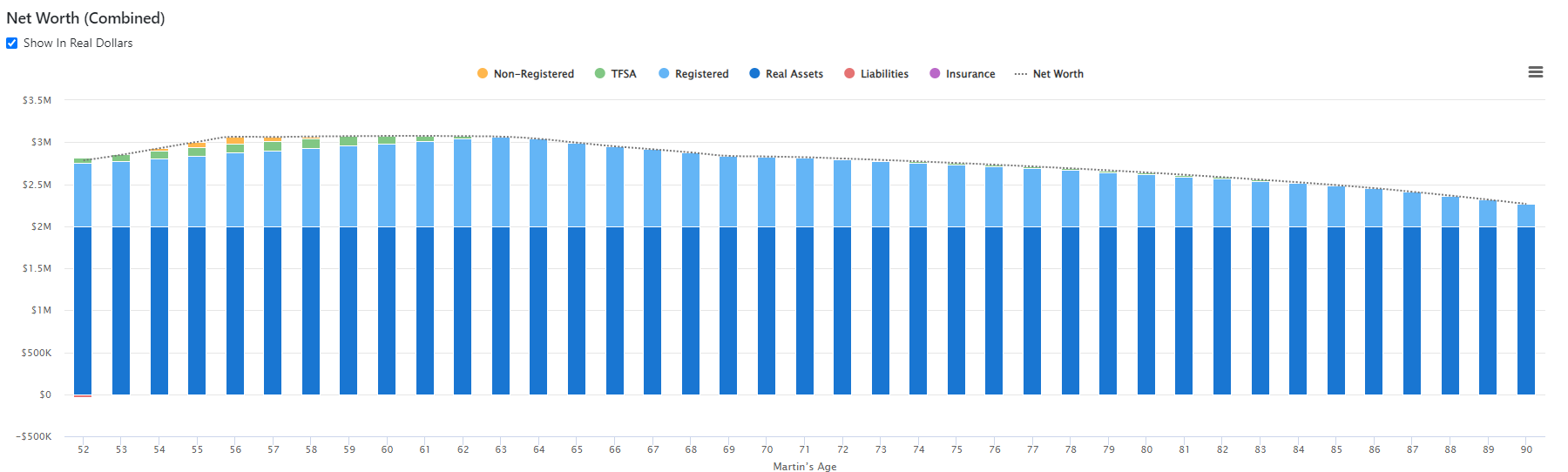

Baseline Scenario Net Worth In Real Dollars

Tax Implications on Retirement Income

- Nature of Income: A significant portion of Jack and Jill’s retirement income will be derived from pensions and withdrawals from registered accounts like self-directed and group RRSPs. While these sources provide a steady income stream, they also come with tax implications.

- Tax Payable: Since both their pension income and withdrawals from registered accounts are subject to taxation, Jack and Jill will need to account for a consistent tax bill in their annual budget. This is particularly important as their primary income sources in retirement do not have the tax diversification that comes from non-registered investments.

Sequence of Returns Risk

The sequence of returns risk refers to the risk that the timing of withdrawals from a retirement portfolio coincides with poor market returns. This risk is most pronounced in the early years of retirement when the portfolio is at its peak and withdrawals begin.

For Jack and Jill, this risk is particularly relevant. As they start to withdraw from their investment portfolio in a market downturn, they might deplete their savings faster than if the market were experiencing positive returns. This is exacerbated by their tax situation, as they are required to withdraw more funds to cover both living expenses and taxes.

This combination of high tax liabilities and sequence of returns risk could significantly impact the longevity of their retirement savings.

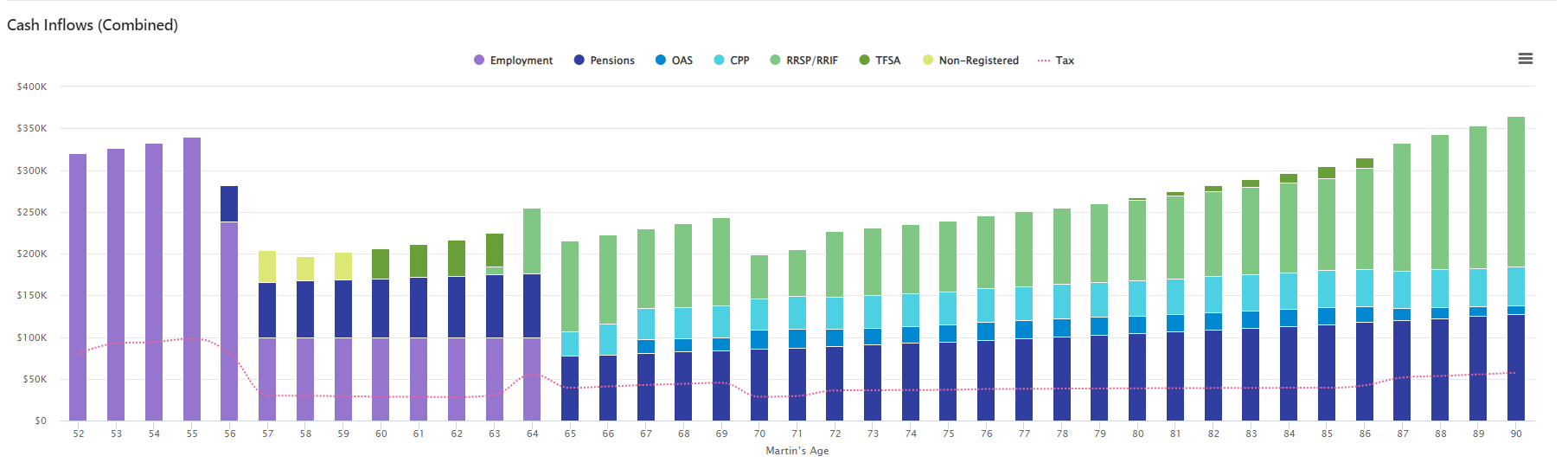

Modeling Market Corrections to Estimate Impact of Negative Sequence of Returns

- Scenario Analysis: To quantify the sequence of returns risk, we modeled their portfolio under the scenario of two market corrections occurring when Jack turns 62 and again at 72. Each correction involves a 15% decline in portfolio value, followed by a partial recovery of 10%, and then a resumption of 6% annual returns going forward.

- Results of the Model: The modeling shows that these market corrections could lead to their capital being exhausted by age 85, which is approximately 5 years earlier than in the baseline scenario where portfolio returns are linear and uninterrupted.

- Implications: This outcome demonstrates the sensitivity of retirement savings to market fluctuations and the critical nature of planning for such events. The difference of five years in capital depletion underlines the potential severity of sequence of returns risk and the need for strategies that can mitigate this risk.

Investment Analysis

In this phase of our comprehensive financial review for Jack and Jill, we focused on evaluating their investment portfolio. This detailed analysis was essential to gauge the effectiveness of their current investment strategy and to identify opportunities for optimization, particularly regarding investment fees and the actual diversification of their portfolio.

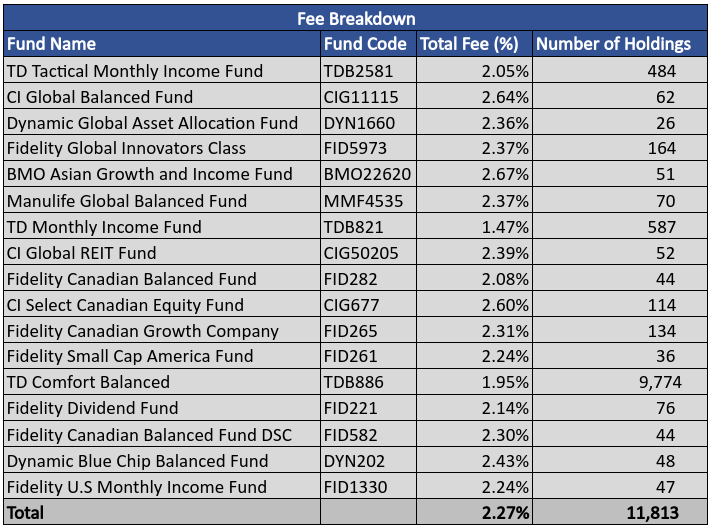

Review of Current Investment Portfolio

- Multiplicity of Mutual Funds: Our examination revealed that Jack and Jill’s investments were distributed across 17 different mutual funds. While this might initially appear as a diversified approach, it actually presented several inefficiencies. In reality, such an extensive spread across multiple funds often leads to overlapping investments, effectively nullifying the intended benefit of diversification.

- High Embedded Fees: A significant issue with their current portfolio was the high embedded fees. These funds carried an average annual fee of 2.27%, a cost that substantially eats into the potential returns of the investments.

- Overlapping Holdings: The collective holdings across these funds amounted to 11,813 different positions. This extreme number indicates considerable overlap, leading to unnecessary complexity and diminishing the intended diversification benefits.

Simplification and Cost Reduction Strategy

- Shifting to Low-Cost Index Funds: To streamline their investment approach and address these challenges, we proposed transitioning their portfolio to low-cost index funds. This move aims to reduce unnecessary complexity, overlap, and high fees associated with their current mutual funds.

- Fee Reduction Impact: By lowering the portfolio’s annual expense ratio by as little as 0.75% annually, we foresee a more efficient and potentially more profitable investment outcome. This strategy is crucial for enhancing their portfolio’s performance, particularly in light of the sequence of returns risk. What is more, the potential fee reduction is could be significantly larger than that.

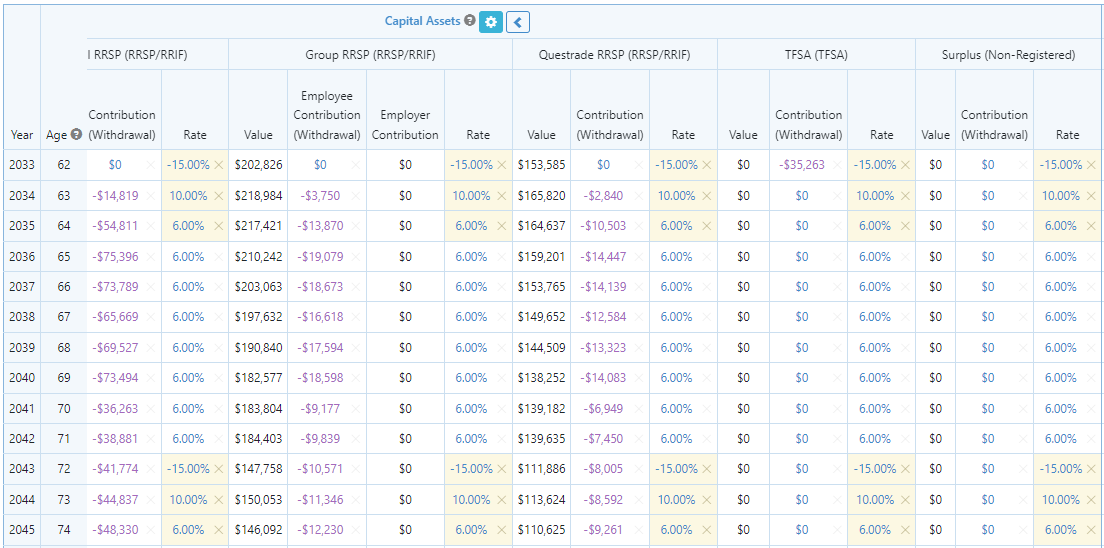

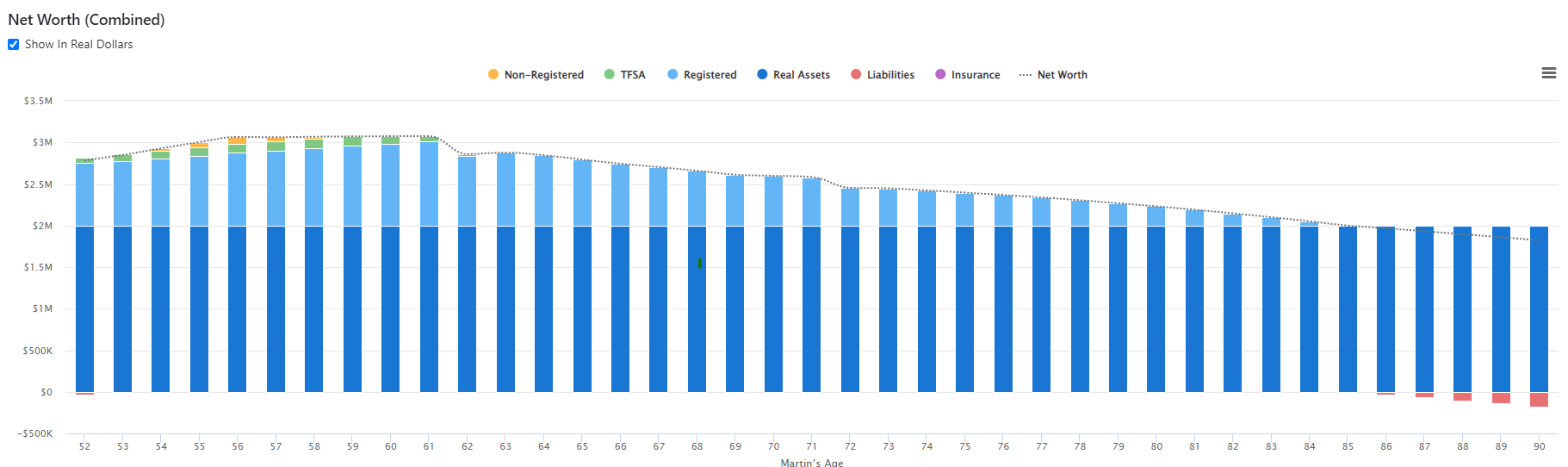

Revised Investment Strategy Scenario Analysis

- Adjusted Rate of Return: In our revised scenario, we increased the projected rate of return on their investments from 6% to 6.75%, accounting for the reduction in investment fees and a more streamlined investment approach.

- Sustainability of Savings: With this adjustment, our models indicate that Jack and Jill’s savings could now last until they are 90 years old, an improvement from the initial projection of their funds depleting by age 85.

Conclusion

The financial journey of Jack and Jill underscores the critical importance of comprehensive retirement planning and proactive investment management. Through our detailed analysis, we identified key areas of concern, such as the tax implications of their income sources and the sequence of returns risk associated with their retirement savings. By reevaluating their investment portfolio and transitioning to a more cost-effective and streamlined investment strategy, we were able to enhance the longevity and resilience of their retirement funds.

This case study highlights the necessity of continuous financial assessment and adaptability to changing market conditions. It serves as a testament to the value of tailored financial advice and the significant impact it can have on achieving a secure and fulfilling retirement. For Jack and Jill, the path forward is now clearer, offering them a more confident stride into their retirement years, with a well-structured plan that balances their financial needs and life aspirations.