What is Portfolio Diversification?

The first rule of finance is that investing involves risk and portfolio diversification is the only guaranteed way to reduce risk. Returns are never guaranteed, and investors should pay specific attention when choosing stocks and other securities.

The major types of risks that an investor is exposed to are inflation rate risk, business risk, political risk, liquidity risk, interest rate risk, foreign investment risk, and default risk.

- Inflation rate risk refers to risks that unexpected inflation could significantly impact the purchasing power of a currency.

- Business risk is the risk that a company would not operate as efficiently as expected because of internal problems or external threats like an introduction of a better product by a competitor.

- Political risk refers to the risk of an unfavourable political situation for investment in a particular country.

- Liquidity risk is the risk that an investor will not be able to quickly sell their securities in the market at the fair market price.

- Interest rate risk is the risk that a change in interest rates could impose on a particular investment. For instance, an increase in interest rates leads to a decrease in bond prices, so a bondholder’s return would be compromised in such an event.

- Foreign investment has many risks involved, one of which could be a change in the exchange rate, which could decrease an investor’s returns in their currency.

- Default risk is the risk that a company will not be able to pay its obligations to the investors.

Investors can classify these risks into two broad categories: unsystematic risk, which relates to a specific company's performance, and systematic risk, which affects the entire economy. Holding positions in multiple companies effectively reduces unsystematic risk but doesn't mitigate systematic risk, as it impacts all companies. This strategy of minimizing unsystematic risk is known as diversification. To safeguard their returns, investors should diversify their portfolios by holding a mix of stocks, bonds, and other securities.

Various methods exist for calculating risk, with standard deviation being the most common. This statistical measure indicates how much a set of numbers deviates from the mean. A higher standard deviation signifies more volatile returns and, consequently, higher risk for the investor holding that security. Another commonly used metric is "beta," derived from the Greek letter β. Beta measures a stock or portfolio's volatility in relation to the overall market. A beta of one indicates that the stock moves in sync with the market.

Beta greater than one suggests that the stock is more volatile than the market. For example, if a stock has a beta of 1.2 and the market increases by 1%, the stock should theoretically yield a 1.2% return. A beta less than one indicates a more stable asset less affected by market swings. Stocks with a beta less than zero are rare, as they would move opposite to the market due to the pervasive influence of systematic risk. Gold is a notable exception, often considered a zero-beta asset.

Risk by Asset Class

Risk is closely associated with return. In general, the riskier the asset, the higher the return. This logic stems from the fact that investors should be compensated with a higher return for bearing higher risks.

Different asset classes carry different risks. The least risky assets are the Treasury Bills (short term bonds issued by the Canadian government). They are usually considered to be “risk-free”, and their return is used as a benchmark for the short-term inflation rate. In general, bonds issued or guaranteed by the federal, provincial, and municipal governments tend to be least risky, and bonds with shorter duration tend to be less risky than similar bonds with longer duration because economic conditions could change more in the long-term. Corporate bonds tend to be a bit riskier than government bonds because they include default risk (the government is essentially free of default risk).

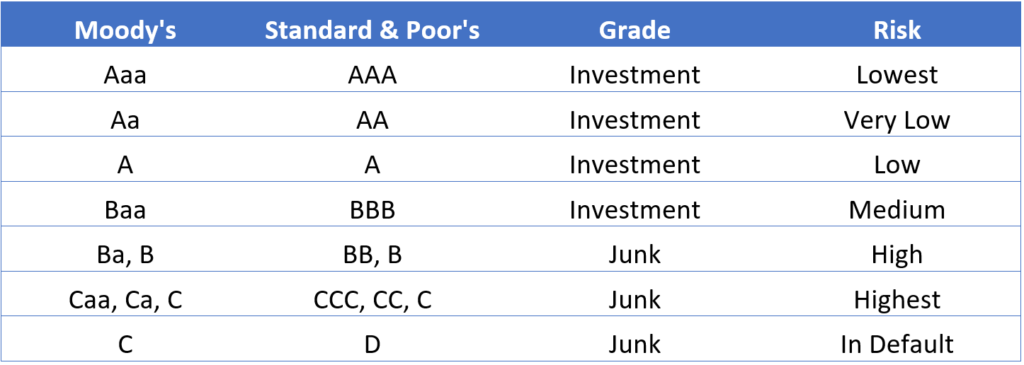

Bonds issued by more stable companies (well-established with sufficient cash inflows and income) will be less risky that smaller growth companies for which the probability of default is considerably higher. The level of bond risk is most commonly reflected by the bond ratings performed by analytics companies like Moody’s and Standard and Poor’s. Bonds rated Aaa (or AAA) have the highest rating and the lowest risk. Bonds with ratings of Baa (or BBB) and higher are referred to as investment grade and carry low to moderate risks. Ratings below that are considered junk (or speculative) since they involve a lot of risk. A short guide to the bond ratings can be found in Table 1 below.

Table 1. Moody’s and Standard and Poor’s Bond Ratings

Equities are the riskiest asset class, and their expected return is also the highest. Bonds are usually guaranteed by a pledge on assets of the company, and bondholders are paid first in case of bankruptcy, while shareholders are entitled only to residual claims on whatever is left after bondholders are compensated. Stocks also do not pay regular interest like bonds, and the dividends they may wish to pay are up to the discretion of management; thus, they are uncertain.

How to Achieve Good Portfolio Diversification?

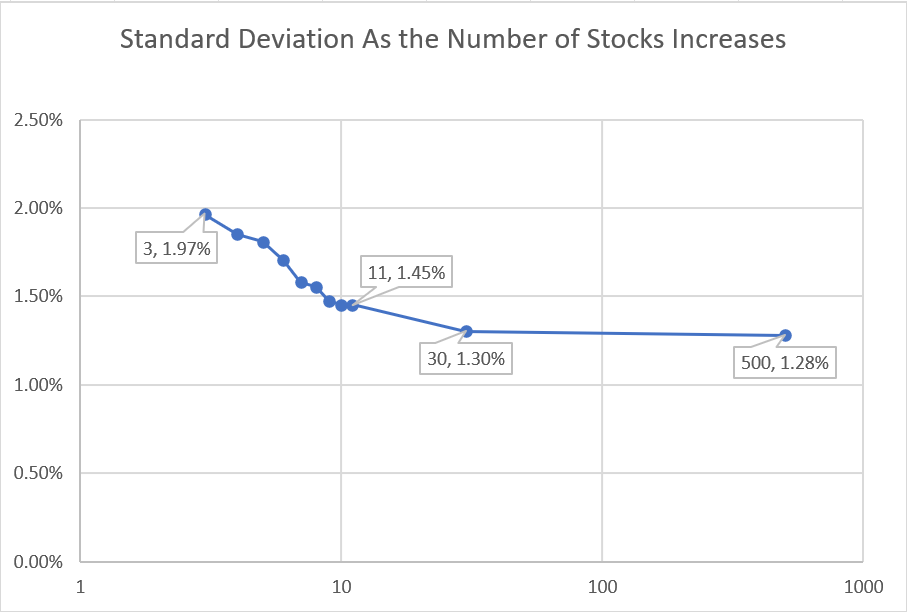

The general way of diversifying risk is by investing in multiple different companies and asset classes. The marginal benefit of adding a new security to a portfolio tends to decrease as the number of securities in higher. This is because all securities have systematic risk which cannot be diversified away, and at some point, when a portfolio is well-diversified, the investor cannot achieve additional diversification as the only risk involved in their portfolio is the general market risk. A well-diversified portfolio will consist of at least 30 different securities as shown in Figure 1 below.

The graph depicts how the risk (measured by the standard deviation of the portfolio on the y-axis) decreases as the number of securities in the portfolio increases. One could clearly see that the highest reductions of standard deviation occur when the portfolio consists of very few positions, and how there is virtually no additional benefit of diversification once a portfolio reaches 30 positions as the standard deviation at that point is approximately equal to the standard deviation of a portfolio with 500 positions. (For more information about how the graph was constructed you can read Appendix 1.)

Figure 1. The Relationship Between Risk (Standard Deviation on the y-axis) and the Number of Stocks in a Portfolio (on the x-axis).

In addition to the number of stocks in a portfolio, an investor should also examine the correlation between individual holdings. Correlation is a statistical metric that shows how two sets of data depend on each other. A correlation of 1 means that if one stock rises, the other will also rise proportionally. A correlation of -1 indicates that if one stock rises, the other will fall proportionally. A correlation of 0 means the two stocks move independently. Because systematic risk affects all stocks to some extent, few stocks have negative correlation. To maximize diversification benefits, investors should aim for stocks with lower correlation. Stocks that move in sync often respond to the same factors, so if one falls, the other is likely to fall as well, causing significant investment loss.

One effective way to achieve low correlation is to pick stocks from different industries. Companies within the same industry often face similar risks. For example, a sudden spike in gas prices will likely hurt all companies in the transportation sector, while having little effect on the technology sector. Investing in companies from diverse industries lowers risk and enhances diversification.

Another strategy for achieving low correlation involves diversifying across different asset classes like stocks, bonds, real estate, and commodities. This approach offers more diversification because these asset classes usually have low or even negative correlation. For example, stock and bond prices often move in opposite directions. In a strong economy, investors favor stocks for greater capital gains, pushing stock prices up. During recessions, people turn to bonds for their more secure and less risky returns, which drives up bond prices and lowers stock prices.

While factors like interest rates and inflation can affect all investments, investing in international markets can also be an effective diversification strategy. However, these investments are not without risk, as major economic events often have global repercussions. For example, the 2007-2009 recession originated in the U.S. but led to a worldwide economic downturn.

How does Portfolio Diversification Work?

When an individual invests in a portfolio, the return they receive is a weighted average of the returns from each asset in the portfolio. For instance, if you invest $1,000 in AAPL (Apple) and $2,000 in MSFT (Microsoft), and AAPL yields a 9% return while MSFT yields a 6% return for a given period, you can calculate the portfolio's return as follows: 10003000×9%+20003000×6%=7%. The standard deviation of the returns depends not just on the relative weights of the assets, but also on the correlation between the stocks.

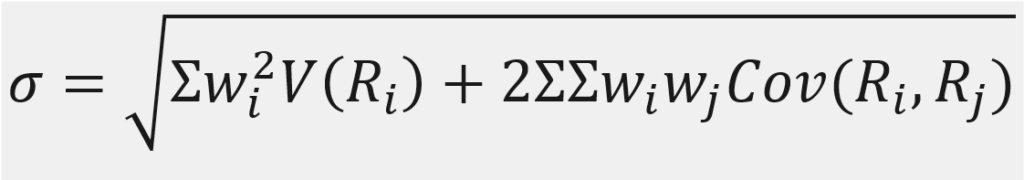

You can find the exact statistical equation in Appendix 2. A key insight from this equation is that the portfolio's standard deviation will always be lower than the average of the individual assets' standard deviations, as long as the assets are not perfectly correlated. In reality, no two stocks have a perfect correlation of 1. Therefore, adding more securities to a portfolio reduces its standard deviation of returns, and the overall return will rise if the new stock's return exceeds the current portfolio return. However, a note of caution: adding extra stocks doesn't always reduce the standard deviation. For more details, see point 6, "Note of Caution."

How much Portfolio Diversification is Too Much?

While the benefits of diversification for risk reduction are undeniable, extreme diversification is not particularly advisable either because it may compromise returns, diversification benefits are negligible on portfolios of more than about 30 stocks, and it might generate higher fees.

The famous investor and CEO of Berkshire Hathaway Warren Buffett has said that “Diversification is a protection against ignorance. It makes little sense if you know what you are doing.”[1]

The idea behind this quote suggests that an investor can achieve higher returns by focusing their investments on a few companies in select industries. The rationale is that while diversification lowers risk, it may also dilute returns. In a diversified portfolio, gains from some securities might largely cancel out losses from others. Warren Buffett argues that an investor with deep knowledge of specific companies and industries can anticipate market movements and earn higher returns. For example, a technology sector expert can quickly react to industry news by either buying or short-selling securities, generating returns during both market upswings and downswings.

A real-life example is Warren Buffett himself. As of the first quarter of 2022, Berkshire Hathaway's investment portfolio, which is Buffett's company, had limited diversification: 41% in Apple (AAPL) and 72.2% in their top five holdings (Apple, Bank of America, American Express, Chevron, and Coca-Cola). However, this strategy works only if the investor understands the companies and industries well and can act quickly on market trends and news. Active trading is also a requirement for this strategy, unlike a conservative buy-and-hold approach.

For most investors, continually tracking the market and executing numerous buy and sell orders in a short period is unrealistic. Even for those who prefer a more passive buy-and-hold strategy, excessive diversification may not be ideal. The benefits of diversification largely plateau once a portfolio contains about 30 different positions. Beyond that point, most of the risk is systematic and cannot be diversified away. Adding more securities could actually hurt overall portfolio returns, as significant gains from a specific stock would be diluted in a portfolio with too many securities.

Additionally, an overly diversified portfolio could result in higher fees for the investor, depending on the specific securities and brokerage fees involved. The more securities you trade, the more fees you'll likely incur.

Investors seeking a relatively passive strategy with stable returns should diversify their portfolio of assets to decrease the portfolio risk, yet they should be careful not to diversify too much because this could damage the returns and trigger higher fees.

Note of Caution

An important note to make is that portfolio diversification does not guarantee that the standard deviation (and thus the risk) will be reduced. As explained previously, the standard deviation of two assets put in a portfolio will be lower than the average standard deviation of the assets. However, this does not imply that the portfolio’s standard deviation will be lower than both assets’ standard deviations, it will just be lower than their average standard deviation. Adding a very volatile asset to a portfolio might as well increase the portfolio’s total volatility.

For instance, if an investor has an asset A with a standard deviation of 1.4% and adds another asset B with a standard deviation of 3%, the new portfolio’s standard deviation could be 1.6%, which is lower than the two assets’ standard deviations (average standard deviation = (1.4% + 3%)/2 = 2.2%), yet it is higher than the standard deviation of just holding asset A.

Investors should also keep in mind that the risk of an asset (as measured by its standard deviation) is calculated solely using historical returns. Historical returns, however, are not a perfect reflection of the future; instead, they are just a benchmark that professionals use to estimate the risk. The asset might underperform and turn out to be riskier than expected.

Diversification is very useful for decreasing (and ultimately eliminating) the systematic risk, however there is still some systematic risk that cannot be diversified away. Thus, no diversification strategy will result in a completely risk-free investment.

Appendix 1 – Graph

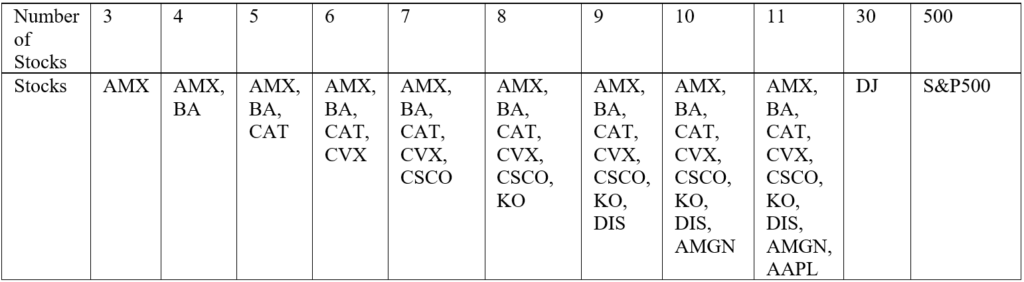

The point representing the portfolio of 30 stocks is the SPDR Dow Jones Industrial Average ETF Trust, which measures the performance of the Dow Jones Industrial Average index. The point representing the portfolio of 500 stocks is the Vanguard 500 Index Fund, which measures the performance of the S&P 500 index. The other points represent portfolios constructed using the first eleven stocks of the Dow Jones Industrial Average index in alphabetical order. For a detailed breakdown of the composition of the portfolios, please refer to Table 2. The returns and their associated standard deviations are calculated using the daily stock adjusted close for a period of 5 years between June 05, 2017, and June 2, 2022, downloaded from Yahoo finance.

Table 2. Portfolio Stock Composition

Appendix 2 – Formula

The exact statistical equation is that the portfolio standard deviation is equal to the square root of the sum of each stock’s variance times the corresponding weight squared plus two times the covariance of the stocks times their weights:

, where σ is the portfolio’s standard deviation, wi refers to the weight associated with stock i, V is the symbol for variance, Ri is the return of stock i, and Cov(Ri, Rj) is the covariance of the returns of stocks i and j. (For the purpose of this text the proof of the aforementioned formula is omitted since it involves a good understanding of statistics.)

[1] Yahoo Finance. “Warren Buffett: 3 to 6 Stocks Is Enough.”, 2021

[2] Investopedia. “Top 5 Positions in Warren Buffett’s Portfolio.”, 2022