1. Executive Summary

The income of Canadians is heavily taxed both at federal and provincial level, which makes tax and retirement planning a crucial step to discovering the optimal allocation of investments that would allow for the highest possible net after-tax savings. The Registered Retirement Savings Plan is a commonly used investment vehicle that allows investors to increase their retirement savings by deferring paying their taxes until retirement when their marginal tax bracket will likely be lower. The Tax-Free Savings Account offers full tax shelter for an investment portfolio. Funds can be withdrawn at any time completely tax-free, but the investments themselves are made with after-tax money in the first place. In this white paper, we will examine under which conditions an individual should prefer investing in RRSP or TFSA for their retirement.

In short, our tests indicate that the RRSP is undeniably the better option for most investors for tax savings. TFSA tends to become more profitable mostly in the case when the investor’s marginal tax rate today is substantially lower than at retirement. The amount of time until retirement can also have an impact on the decision, yet it is secondary to the marginal tax bracket in retirement. Other factors like the rate of return or the time in retirement tend to have a lower impact on the decision.

Investors can also take advantage of the possibility of a transfer from a TFSA to an RRSP. This action can bring benefits to individuals expecting to have a higher income in the future, which would move them to a higher marginal tax rate. Investing in a TFSA now would allow them to save RRSP room, and then transfer their investments to an RRSP and receive a rebate at a higher marginal rate instead of receiving it today at the lower rate. However, this strategy cannot be utilized by individuals who have already reached the highest possible marginal rate or do not expect an increase in income big enough to move them to a higher tax bracket.

Overall, the decision of whether to invest in an RRSP or a TFSA can prove to be crucial for achieving the highest possible return at retirement while also maximizing tax savings today. This paper provides a high-level overview of different investor circumstances and the corresponding investment decisions that would prove to be most beneficial. However, when making this decision, it is highly recommended for individuals to speak to an advisor to further explore their options and find the best alternative that suits their individual needs.

2. Introduction: How do RRSPs and TFSAs work?

The Registered Retirement Savings Plan (RRSP) and the Tax-Free Saving Account (TFSA) are the two main investment vehicles used by Canadians to reduce investment income taxes. The TFSA offers full tax shelter and any funds invested in the account can be withdrawn at any time without paying any taxes. The RRSP on the other hand offers a tax-deferral option for investors by providing a tax exemption immediately, and the proceeds from the investments (the initial investment plus any return on the investment) are taxed as regular income when withdrawn at retirement. In short, investments in the TFSA are made with after-tax money and the return is not taxed at all, while the investments in the RRSP are made with pre-tax funds (the investor receives a tax rebate) but are fully taxable when taken out.

Investors who have a large amount to invest (higher than the sum of the allowed contribution room for RRSP and TFSA) would choose to maximize the room in both accounts in virtually all cases. However, in cases when investors cannot afford to make a large contribution to both accounts, they will have to carefully analyze which account would provide them a higher after-tax return and invest there first. While the TFSA might seem more profitable for investors because it is completely tax-free, the RRSP offers a higher net return for most investors. This mostly stems from the fact that even if RRSP returns are taxed at the time of distribution, investors are 1) reducing their tax bill today when they are in a higher tax bracket compared to where they will be at retirement, and 2) investors can afford to invest more in an RRSP now by also investing the tax rebate they receive. In most cases, one of the two accounts will be strictly more profitable, especially when 1) the investment horizon is longer since there will be a wider difference in the return on investment, and 2) the marginal tax rates now and at retirement are different. In few circumstances, the optimal allocation of funds will involve partial investments in both accounts.

3. Our Approach

In this white paper we analyze the effects different variables have on the choice between making an investment in an RRSP or a TFSA. We will test different cases with an algorithm that was developed for the purposes of this study. The program will evaluate how an investor should allocate their investments across the two accounts based on the specific circumstances of the individual and the investment. We take into account the investor’s income, annual income growth, and the return on investment, among others. For comparison purposes, we assume the investor is saving specifically for retirement, and would not withdraw any amount sooner. We are assuming that the investor will take out equal amounts each year from the two accounts in retirement.

4. Results and Examples

The results from the tests mostly align with the hypothesis that the RRSP is the better way to store one’s investments. The RRSP investment was the preferred option in 5 out of the 6 different base cases we evaluated. Based on the results, we can conclude that the income level was the single most important factor in determining the relative profitability of RRSP and TFSA. The time until retirement was also important, while the number of years in retirement and the rate of return on investment had the smallest impact on the results. Below we outline the few exceptions in which the investing in a TFSA is preferable to investing in an RRSP.

- The TFSA is more profitable only if the investor’s marginal tax bracket at retirement is higher than the marginal tax bracket today.

The income level now and at retirement, and the relative difference between the two was the key determinant of which investment would be better. In five of the six scenarios, decreasing the income now or increasing the retirement income meant switching from an RRSP to a TFSA investment. Thus, when the retirement income is substantially higher than the current income, the TFSA become the better investment account. However, the gap between the present and future incomes is not the only determinant. If both incomes are high (in the highest marginal brackets), then further increasing the retirement income does not yield any benefits, but instead decreasing the current income does. Thus, the TFSA is more profitable now if the marginal rate is higher when we take the money at retirement than it is today. This makes sense because we would not want to invest in an RRSP and postpone paying taxes if our tax rate will be higher in the future.

An example of a case when the TFSA investment is better would be an individual with a $90,000 income now and an expected retirement income of $160,000. For 2022 in Ontario, this translate in a current tax bracket of 31.48%, while the one at retirement will be 48.35%. According to our algorithm, one should invest in the TFSA first.

However, in real life, most people will have a lower income in retirement than they do today. For these individuals, investing in the RRSP would provide bigger benefits.

- The TFSA is more profitable if the time until retirement is longer

This result can closely be tied to our previous discussion. The longer period until retirement means more time for contributions in either RRSP or TFSA, which essentially increases the retirement income, which in turn makes the TFSA investment more profitable.

An example for that would be an individual with a $190,000 income now and a slightly higher income of $240,000. The algorithm favours the TFSA investment if the time until retirement is at least 23 years. Note that this is also a scenario in which the retirement marginal tax bracket would be considerably higher than the current one.

- The number of years in retirement and the rate of return on investment

The other two variables we examined, the number of years in retirement and the rate of return on investment, did not change the investment decision in any of the analyzed cases. Thus, it can be concluded that they had the smallest impact on the decision. It is important to note that under the assumptions of the algorithm, the only effect that the retirement period had was the allocation of the return of the investments – the higher the period, the smaller the total income for each given year. However, in practice, the redemption of the return can follow a different pattern, in which case the effect may be different. Yet, the fact that these two variables are the ones with the smallest impact can generally be regarded as a good thing since they are the variables that involve the highest level of uncertainty in practice, and they are the most difficult to predict precisely. Still, according to our results, changes in either of the two will rarely shift the decision of whether to invest in a TFSA or an RRSP.

- Transfer funds from the TFSA to the RRSP given a high increase in the investor’s annual income

Investing in TFSA in the present gives the investor the option to make a transfer to an RRSP at a later date. This transfer would be considered a contribution to the RRSP, so it will result in a tax rebate at the time of the transfer. Individuals with a high expected increase in their income can take advantage of this option since they can invest in a TFSA now and save RRSP contribution room for when they have a higher income. Simply put, the investor would pay tax now, invest in a TFSA, let the investments grow until the investor reaches the expected income increase, transfer the investments to the RRSP, and receive a tax rebate at the higher marginal tax rate, and then leave the investments in the RRSP until retirement. This could be done to save RRSP contribution room for the higher earning years to get the higher tax rebate.

Our tests yield that for anyone with an income that will fall in a higher marginal tax bracket should invest in the TFSA now and transfer the investments to the RRSP when they reach the higher income level. For instance, a rational investor earning $100,000 (marginal bracket of 37.91%) who expects an increase in income to anything more than $102,000 (marginal bracket of 43.41%) in a few years would invest in the TFSA now and then transfer the investments to the RRSP.

However, if an individual already falls in the highest possible marginal tax bracket, then they cannot take advantage of the transfer since no future income would move them to a higher tax bracket.

-

TFSA is more profitable for investments to be taken out before retirement

We should also make a short note on any other reason an individual would have a preference for one of the two accounts. Apart from the tax implications, a major difference between the TFSA and the RRSP is the timing of the withdrawal. The RRSP is specifically designed for retirement savings. Thus, any amount withdrawn before retirement will bear significant withholding taxes. The TFSA, however, is intended for all types of expenditures, and one can withdraw any amount at any time, tax-free. If an investor is not saving specifically for retirement and might need the funds earlier, they would be strongly encouraged to invest in a TFSA. The right option can be confirmed only after evaluating the investor’s personal circumstances.

5. Appendix 1: Detailed Discussion of the Theoretical Advantages

The most important variable when making the decision between investing in an RRSP or a TFSA is the income level of the investor. High income earners in the top marginal tax brackets would almost always be better off investing in an RRSP because it will offer significant tax savings now. These individuals would choose to invest in an RRSP and get a tax rebate today. They would rather defer their tax payable until retirement when their marginal tax bracket would likely be lower. The tax rebate can also be rolled over in the RRSP, so its return will also be compounded over the long run. However, if the individual expects to have high retirement taxable income (comparable to the current income, or even higher than the current income), they will end up paying more in taxes if they invest in an RRSP. This is because the proceeds will be taxed at a higher tax rate at retirement, and both the initial investment and the return will be heavily taxed. In this case, the investor would likely prefer a TFSA investment since they will at least avoid paying taxes on the return on the investment. Thus, the decision to invest in a TFSA or an RRSP will be dictated by whether the return of investing more now (investing in RRSP with the tax rebate) will outweigh the TFSA tax savings at retirement.

A closely related variable to the retirement income would be the length of retirement. All else equal, the shorter retirement is, the higher the income in these years (the algorithm assumes a constant annual income). This is because the return on investment in RRSP, TFSA, and possibly other non-registered accounts will be distributed over a shorter period, meaning that each year the dollar amount the investor will receive will be higher. This will essentially push the investor’s marginal tax bracket up in most circumstances, and that will cause the RRSP to be less profitable.

Another crucial factor is the investment horizon; that is, the number of years until retirement. Investments in an RRSP are made with pre-tax funds, while investments in a TFSA are made with after-tax money. From a practical perspective, if an investor decides to invest $20,000 of their $100,000 after-tax income for the year to be left with $80,000 disposable income, they can either invest $20,000 in a TFSA (and the contribution will total $20,000), or invest in an RRSP, get a tax rebate, and invest the tax rebate as well, and then the total RRSP amount would be more than $20,000, but the investor would still be left with the same $80,000 of disposable income. One can invest more in an RRSP than in a TFSA and still have the same disposable income today. This creates a gap between the initial investments in the two accounts, which will be compounded over the years. For instance, two investments of $1000 and $1100, respectively, at 8% annual growth will have $100 difference at the start, $147 after 5 years, $216 after 10 years, and $466 after 20 years in the account. Over the long run, the higher initial investment in an RRSP could yield significantly higher returns. The difference becomes wider as the investment horizon becomes larger. However, the higher return will also be more heavily taxed so it is possible the after-tax growth of the RRSP at retirement will be lower than the growth of the TFSA despite the compounding process. Whether that is the case would depend on the difference in the investor’s tax brackets before and after retirement. If the investor will be in the same tax bracket now and at retirement, then both investments are (approximately) equally profitable, no matter how long the investment stays in the accounts.

The investment return can create a big difference between the total returns of the RRSP and the TFSA with the higher initial investment in RRSP. Intuitively, the higher the annual return, the bigger the gap will be. However, the annual return cannot be fully controlled or predicted as opposed to variables like the income of the individual or the time until their retirement.

6. Appendix 2: Test Cases and Detailed Results

The method of research was to use a base case scenario and see whether and how big of a change in a single variable, holding everything else constant, would yield a different result. The variables that we changed are the current income, retirement income separate from investment income, the return on investment, the number of years to retirement, and the number of years in retirement. Six different base case scenarios were developed, all with different income and time horizons. These base cases were chosen so that their parameters are highly different, and not to reflect real investor situations. A short summary of the variables chosen for the base scenarios are displayed in Table 1.

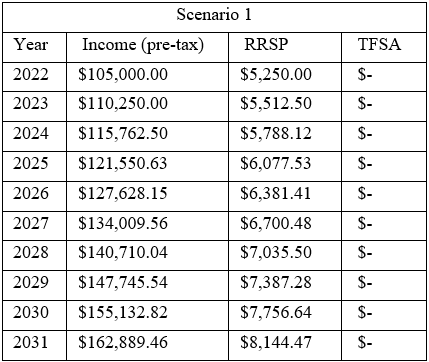

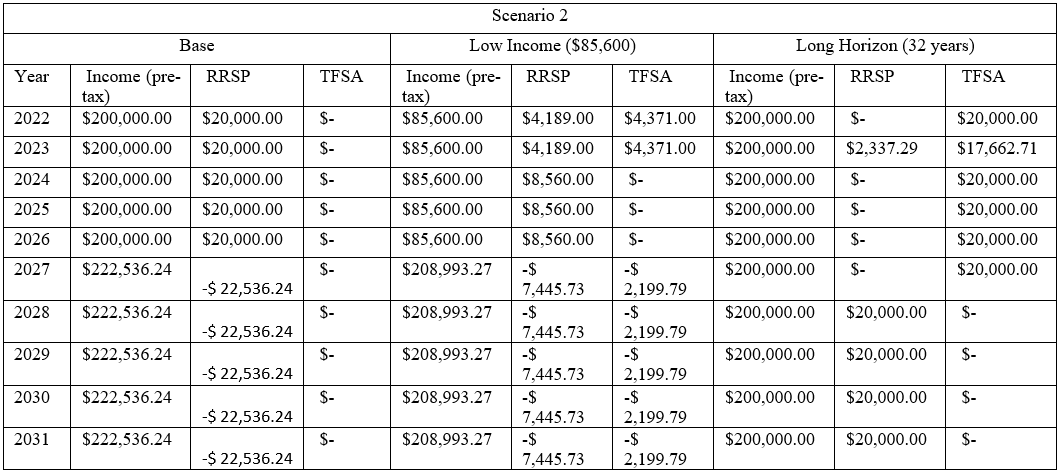

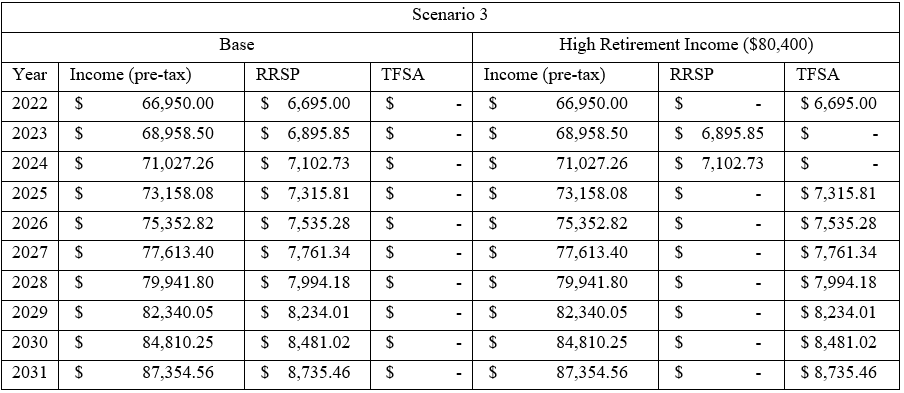

Results are presented in the format where we have the year, the corresponding income for the year (pre-tax), the investment in an RRSP, and the amount of pre-tax funds that go in a TFSA. The investments in the TFSA, however, will be after-tax.

The allowed changes of the variables were up to $500,000 for the income and retirement income, 10% of the return, and up to 50 years of difference, or until we reached a negative value for any variable.

|

Scenario |

1. |

2. |

3. |

4 |

5 |

6 |

|

Income |

$100,000 |

$200,000 |

$65,000 |

$90,000 |

$100,000 |

$190,000 |

|

Retirement Income |

$2,000 |

$200,000 |

$15,000 |

$160,000 |

$20,000 |

$240,000 |

|

Years to Ret. |

10 |

5 |

25 |

13 |

15 |

20 |

|

Years in Ret. |

10 |

7 |

30 |

35 |

20 |

15 |

Table 1. Summary of the Scenarios

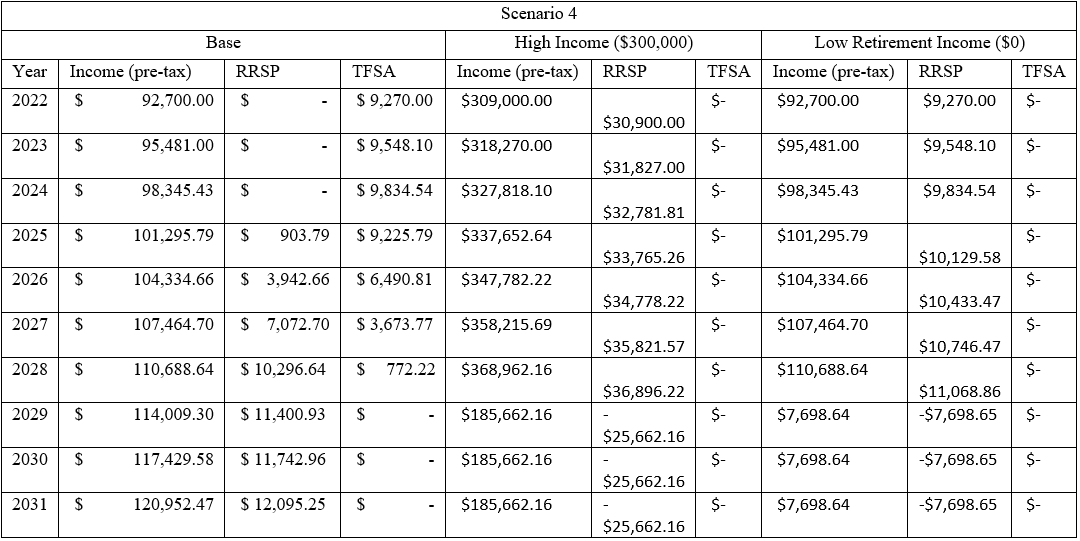

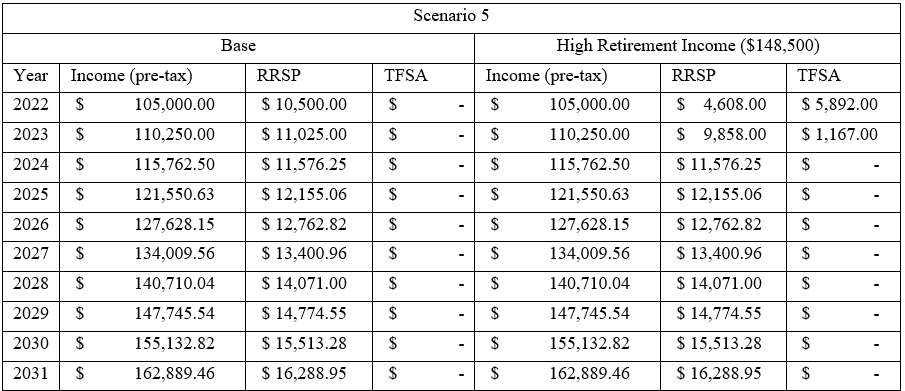

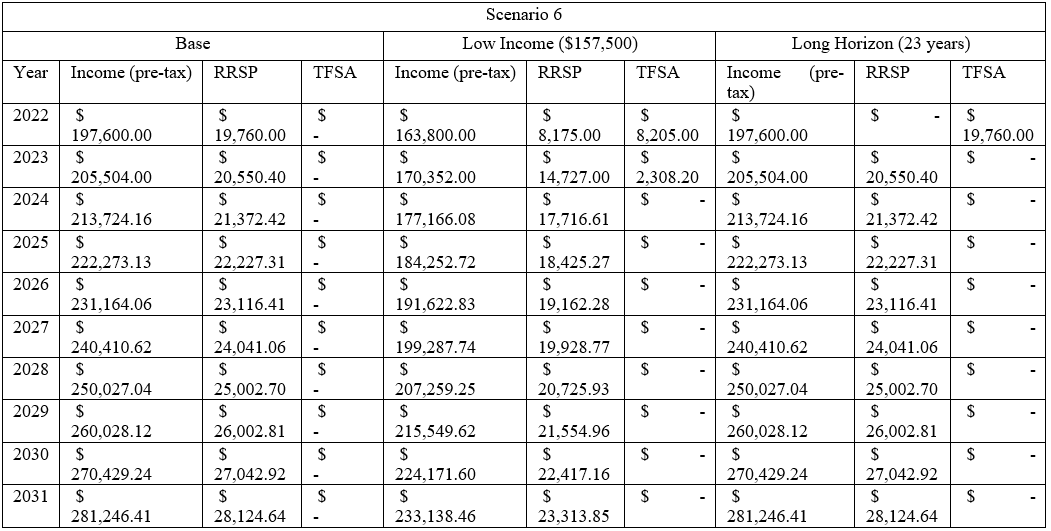

Scenarios 1, 2, 3, 5, and 6 all favoured the RRSP investment, while only in scenario 4 one should start by investing in TFSA. In all scenarios except the first one, a change in the relative difference between the current income and the retirement income led to a change in the decision of where to invest first. In scenarios 2 and 6 materially lowering the current income caused us to prefer the TFSA investment, while such a result was observed in cases 3 and 5 when the retirement income is significantly higher. In scenario 4 if we either decreased the retirement income or increased the current income, the RRSP investment became more profitable. Thus, widening the difference between the marginal tax brackets now and at retirement led to a different investment choice.

In scenarios 2 and 6 we also observe that if we increase the investment horizon, we will end up preferring TFSA to RRSP investments.

Snippets of the first few periods of investment can be found for all cases below, including the situations in which the decision from investing in an RRSP shifts to a TFSA.

A separate algorithm was developed that estimates the profitability of a transfer from a TFSA to an RRSP. The program compares the return of investing in RRSP right away to investing in TFSA now and then transferring the investments to an RRSP at a pre-determined time in the future. We developed 4 base cases that are outlined below in Table 2.

|

Scenario |

1. |

2. |

3. |

4 |

|

Income |

$100,000 |

$100,000 |

$65,000 |

$250,000 |

|

Years of investment |

5 |

15 |

20 |

20 |

|

Future income |

$200,000 |

$200,000 |

$120,000 |

$350,000 |

|

Amount to invest |

$20,000 |

$20,000 |

$10,000 |

$20,000 |

|

Return on investment |

8 |

8 |

8 |

8 |

Table 2. Summary of Scenarios for Transfer

For the first three cases, it is more profitable to invest in a TFSA and then transfer the funds to an RRSP. In the first scenario the algorithm preferred to use the transfer if the future income is at least $102,000, for the second scenario - $101,000, and for the third scenario - $92,000; for a lower future income investing in the RRSP right away was better in these scenarios. In all three cases, the future income is at a higher marginal tax bracket.

In scenario 4 both the current and the future income are at the highest tax bracket and in this case the transfer does not provide any benefits and both investments are virtually equally profitable (either investing in the TFSA and then using a transfer or investing in the RRSP right away).

7. Appendix 3: Algorithm Explanation

The algorithm estimates how one should allocate their investments across the RRSP and the TFSA depending on their unique circumstances. The variables that the program takes are the income from the previous year, the increase of the income, the percentage of the income to be invested each year, the return of the investments (either in RRSP, TFSA, or other non-registered accounts), the dividend yield and the interest income as part of the total return (all other return would be from capital gains), the number of years to retirement, the income at retirement, the number of years in retirement, the available room in the TFSA and the RRSP, the current year, and the annual inflation rate.

The RRSP contribution room is calculated as the available room from the previous periods plus the minimum of 18% of the last year’s income and the dollar limit, which is adjusted to inflation each year. The TFSA contribution room is the available room from the previous periods plus the annual contribution limit, which is adjusted to inflation and rounded to the nearest $500.

The algorithm calculates the optimal investments for each individual year, starting with the first year of investment. It compares the after-tax income and tax savings of investing in a TFSA to investing in an RRSP and chooses to invest in whichever is more profitable. The income is taken pre-tax, and the investments are considered to be pre-tax, yet they are later adjusted to be after-tax if they are not invested in an RRSP. This would approximately equal an investment in the RRSP plus the tax rebate received from this investment. The investment amount is the minimum of the available room in the RRSP, the available room in the TFSA, the amount until we reach a new tax rate if we invest in the RRSP, the amount until we reach a new tax rate at retirement if we invest in the TFSA (we first assume we invest everything in non-registered accounts and then reduce the taxable retirement income should we invest in a TFSA instead), and the income left to invest. After this amount is invested, every variable is adjusted, and the algorithm will continue to compare the RRSP and the TFSA investments until either both contribution rooms are filled or there is no further income to be invested. Any remaining amount we wish to invest would be invested in non-registered accounts (once both the RRSP and the TFSA contribution rooms are filled). This process is repeated for each consecutive year until retirement.

The income at retirement is calculated so it is distributed with equal amounts received each year based on the amount in all accounts and the expected years in retirement. The investments continue to grow during that period.

The algorithm returns an Excel sheet that shows the pre-tax income, the amounts of income allocated to RRSP, TFSA, and other non-registered accounts, the after-tax amount invested in the TFSA, the amount of contribution room in the RRSP and the TFSA carried forward, and the tax savings from each year. At retirement, the annual amounts for the RRSP, TFSA, and non-registered accounts show the annual withdrawal from each of these accounts. For illustration purposes, the figures in this paper present only the year, income, and income allocated to RRSP and TFSA since this is the key information for determining which account is more profitable.

Author: Alexander Natchev