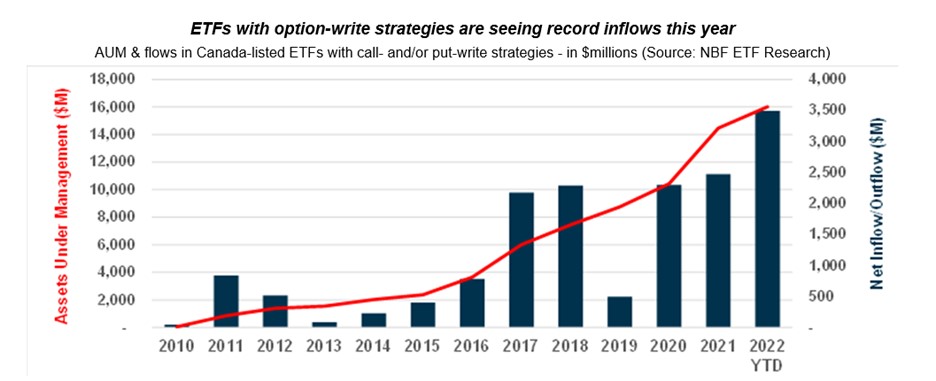

Canadian covered call ETFs have proliferated with the growing demand for high-yielding products during the low interest rate environment of the past decade and especially in 2021 and 2022. Canadian ETF issues have been pumping out new products relentlessly. The trend has been driven by the current bearish sentiment, increased market volatility and the demand for income from an investor public nearing retirement. As a result, this year option-write products will see over $3.5 billion in new deposits.

These ETFs are interesting as they are representative of what makes an investment vehicle marketable. They are straightforward yet complicated enough to appear sophisticated to retail investors looking for consistent income with downside protection.

Although earning additional income on top of dividends by using an options strategy may be tempting, investors need to be mindful of the pitfalls associated with these ETFs.

Covered call ETFs sell (or write) call options on a portion of their underlying securities. They are known as covered calls because the ETF owns the stocks on which the contracts are written. A call option gives the buyer the right to purchase the shares at a specified price before a specified date.

When an ETF sells a call option, it collects a premium from the option buyer, and these premiums allow the fund to pay out additional income. The price of the option will be determined based on the difference between the stock price and the exercise price, the volatility of the underlying stock (where greater volatility leads to a higher price) and the time to expiration of the option contract (where a longer time period leads to a higher price).

Potential Benefits

In theory, covered call strategies would outperform the underlying portfolio in flat and down markets and underperform in periods of market appreciation. The strategy would be most effective when the price of the underlying security is not overly volatile. The strategy will participate in the stock appreciation up to the strike price, with the added benefit of the sold call premium. This income enhancement would reduce the portfolio’s downside in bad times.

Practical Application

In practice, however, call option strategies have consistently provided significantly lower overall investment return to the underlying portfolio without any material reduction in risk.

To find out why this is the case, we will study BMO Covered Call Canadian Banks ETF (ZWB). ZWB has been designed to provide exposure to a portfolio of Canadian banks while earning call option premiums. In practice ZWB writes call options on BMO Equal Weight Banks Index ETF (ZEB). This allows for a perfect comparison between the covered called strategy outcome and its underlying portfolio.

ZEB has performed much better than ZWB over the last decade. This is to be expected as this lower long-term performance is supposed to be traded for downside protection in bad times. However, even in times of market distress, ZEB has done better. Both its maximum drawdown and worst year performance are better than ZWB’s.

Reasons for covered call underperformance

Upon closer examination, there are four main reasons for this underperformance.

1. Opportunity cost for not participating in the underlying security’s gains

The covered call writer does not fully participate in a stock price rise above the strike. In the event of a substantial stock price rise, covered call will incur a substantial opportunity cost. Given that markets tend to rise over time, this opportunity cost will only compound over time.

2. Options pricing mechanics

As volatility increases, the prices of all options on that underlying - both calls and puts and at all strike prices - tend to rise. This is because the chances of all options finishing in the money likewise increase. This means that in order to increase income from options premiums, the option writer has to increase his/her opportunity cost.

3. Return enhancement does not translate into downside protection

Selling covered calls should not be viewed as downside risk management as downsize risk does not change materially versus being long the underlying portfolio. One would manage downside risk by purchasing puts. Selling calls is mainly a return enhancement.

4. High cost of implementation

Covered call strategies are burdened by high trading costs that exert an additional drag on performance. Trading costs are not included in the MER but are broken out separately in the trading expense ratio, or TER, of covered call ETFs.

Tax implications of investing in covered calls

One attractive feature covered call strategies have for Canadian investors is the tax treatment of option premiums. Income from investments in call and put options is taxed as a capital gain which is lower than the tax on interest. However, income from the sale of call options in the States is usually taxed as a short-term capital gain which does not benefit from any special tax rate. Instead, these gains are taxed as ordinary income. Canadians investing in US covered call strategies will be taxed as if they received regular income.